Running a small business is a whirlwind of activity, from managing inventory and customer relations to marketing and sales. One area that often gets overlooked, or put off until the last minute, is bookkeeping. However, accurate and consistent bookkeeping is crucial for understanding your business’s financial health, making informed decisions, and staying compliant with tax regulations. Many small business owners are intimidated by the prospect of bookkeeping, thinking it requires complicated software or an accounting degree. The good news is that with a good template and a little dedication, you can manage your small business bookkeeping effectively.

The Importance of Bookkeeping for Small Businesses

Before diving into the specifics of a template, let’s quickly reiterate why proper bookkeeping is so essential for small businesses:

- Financial Visibility: Bookkeeping provides a clear picture of your business’s income, expenses, assets, and liabilities. This allows you to track profitability, identify areas where you can cut costs, and make strategic decisions about investments and growth.

- Tax Compliance: Accurate records are essential for filing your taxes correctly and on time. Proper bookkeeping helps you avoid penalties and audits.

- Informed Decision Making: Knowing your financial position allows you to make informed decisions about pricing, hiring, expansion, and other critical aspects of your business.

- Loan Applications: If you ever need to apply for a loan or seek investment, lenders and investors will want to see your financial records. Well-maintained books demonstrate financial responsibility and increase your chances of approval.

- Business Valuation: When it’s time to sell your business, accurate financial records are crucial for determining its value.

Using a Bookkeeping Template for Your Small Business

A bookkeeping template provides a structured framework for recording your financial transactions. It simplifies the process by offering pre-defined categories and formulas, eliminating the need to start from scratch. Here’s a breakdown of what a typical small business bookkeeping template includes and how to use it effectively:

Key Components of a Small Business Bookkeeping Template

- Income Tracking: This section allows you to record all revenue generated by your business, whether from sales, services, or other sources. You’ll typically break down income by category (e.g., product sales, service fees, subscription revenue).

- Expense Tracking: This is where you record all expenses incurred by your business, such as rent, utilities, salaries, marketing costs, and supplies. It’s essential to categorize expenses accurately to understand where your money is going.

- Chart of Accounts: This is a list of all the accounts used to track your financial transactions. It’s a fundamental element of bookkeeping and ensures consistency in recording data. Common accounts include Cash, Accounts Receivable, Accounts Payable, Inventory, and Owner’s Equity.

- Balance Sheet: A balance sheet provides a snapshot of your company’s assets, liabilities, and equity at a specific point in time. It shows what your business owns (assets), what it owes (liabilities), and the owner’s stake in the business (equity). The fundamental equation of a balance sheet is: Assets = Liabilities + Equity.

- Income Statement (Profit & Loss Statement): An income statement summarizes your company’s revenues, expenses, and net profit or loss over a specific period (e.g., a month, quarter, or year). It shows how profitable your business is.

- Cash Flow Statement: This statement tracks the movement of cash into and out of your business. It shows how well your business manages its cash flow and is essential for ensuring you have enough cash on hand to meet your obligations.

- Bank Reconciliation: This process involves comparing your bank statement to your internal records to identify any discrepancies and ensure accuracy. It helps prevent errors and fraud.

Tips for Using a Bookkeeping Template Effectively

- Choose the Right Template: There are many different bookkeeping templates available online, both free and paid. Choose one that is specifically designed for small businesses and meets your specific needs. Consider templates compatible with spreadsheet software like Excel or Google Sheets, or explore cloud-based accounting software solutions that offer templates.

- Customize the Template: Don’t be afraid to customize the template to fit your specific business. Add or remove categories as needed to accurately reflect your income and expenses.

- Enter Data Regularly: The key to effective bookkeeping is consistency. Set aside time each week or month to enter your financial transactions into the template.

- Categorize Transactions Accurately: Be sure to categorize your income and expenses accurately to ensure you’re getting a clear picture of your financial performance. When in doubt, consult with an accountant or bookkeeper.

- Reconcile Your Accounts Regularly: Reconcile your bank accounts regularly to ensure your records are accurate and up-to-date.

- Back Up Your Data: Regularly back up your bookkeeping template to prevent data loss in case of computer failure or other unforeseen events.

- Consider Accounting Software: As your business grows, you may find that a bookkeeping template is no longer sufficient. Consider transitioning to accounting software, which offers more advanced features and automation.

By using a bookkeeping template and following these tips, you can effectively manage your small business finances and make informed decisions for long-term success. Don’t hesitate to seek professional help if you need it; an accountant or bookkeeper can provide valuable guidance and support.

If you are looking for Small Business Bookkeeping Excel Template you’ve came to the right web. We have 9 Pics about Small Business Bookkeeping Excel Template like Small Business Bookkeeping Template Business Bookkeeping Spreadsheet, Accounting Template For Small Business Popular Small Business within and also Template For Small Business Bookkeeping | New Professional Template. Read more:

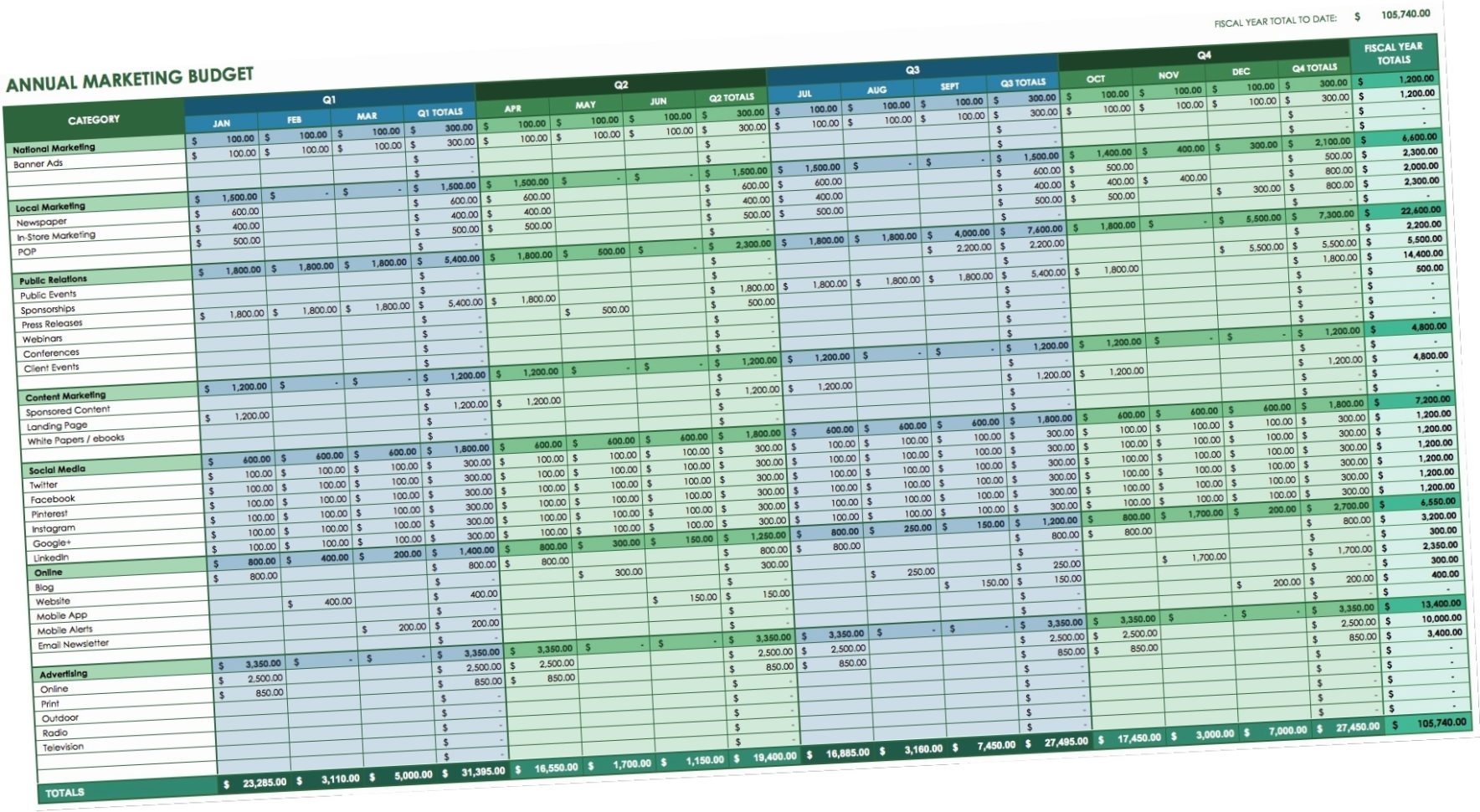

Small Business Bookkeeping Excel Template

template.mapadapalavra.ba.gov.br

Small Business Bookkeeping Excel Template

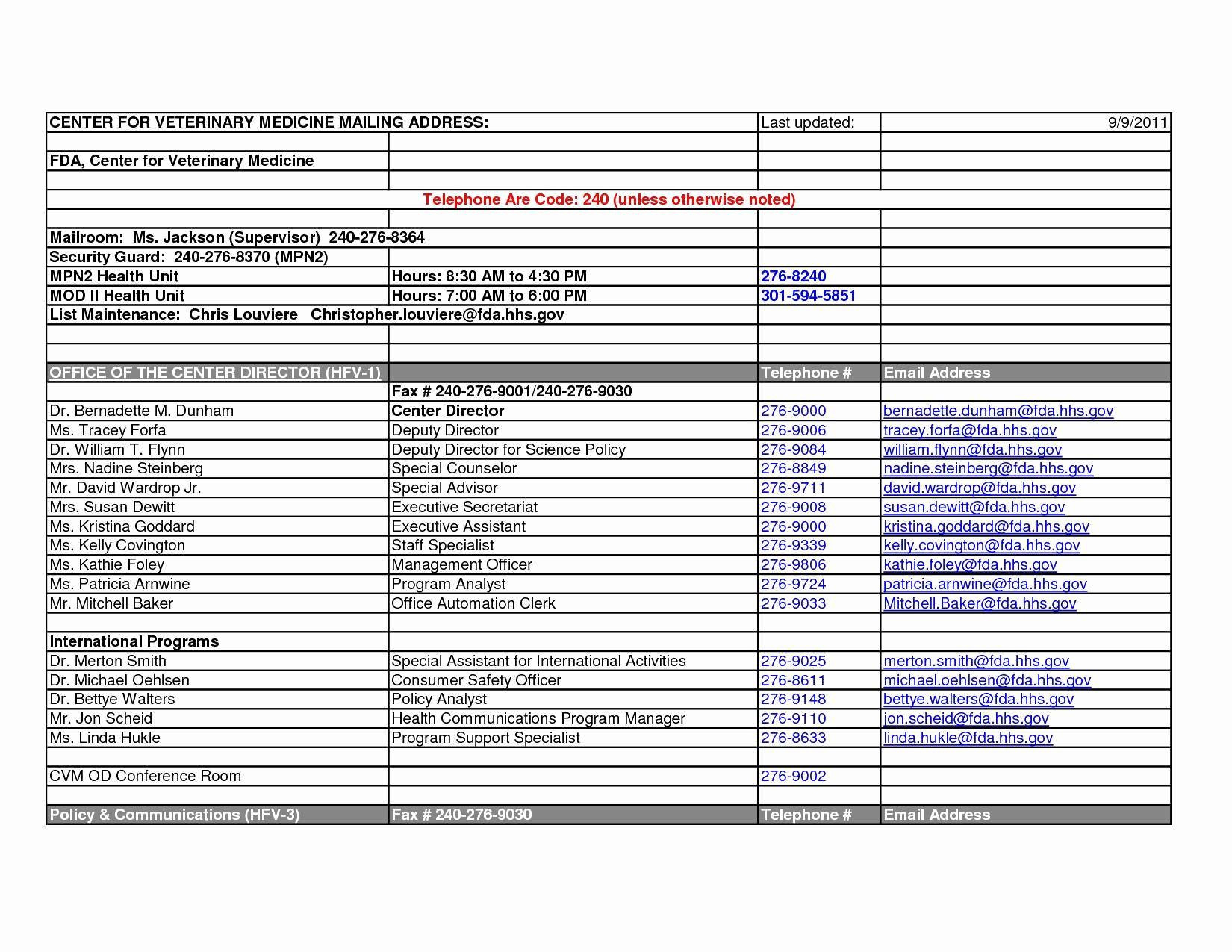

Template For Small Business Bookkeeping | New Professional Template

newprofessional-template.blogspot.com

Template For Small Business Bookkeeping | New Professional Template

Accounting Template For Small Business Popular Small Business Within

db-excel.com

Accounting Template For Small Business Popular Small Business within …

Free Bookkeeping Templates In Excel To Download

www.template.net

Free Bookkeeping Templates in Excel to Download

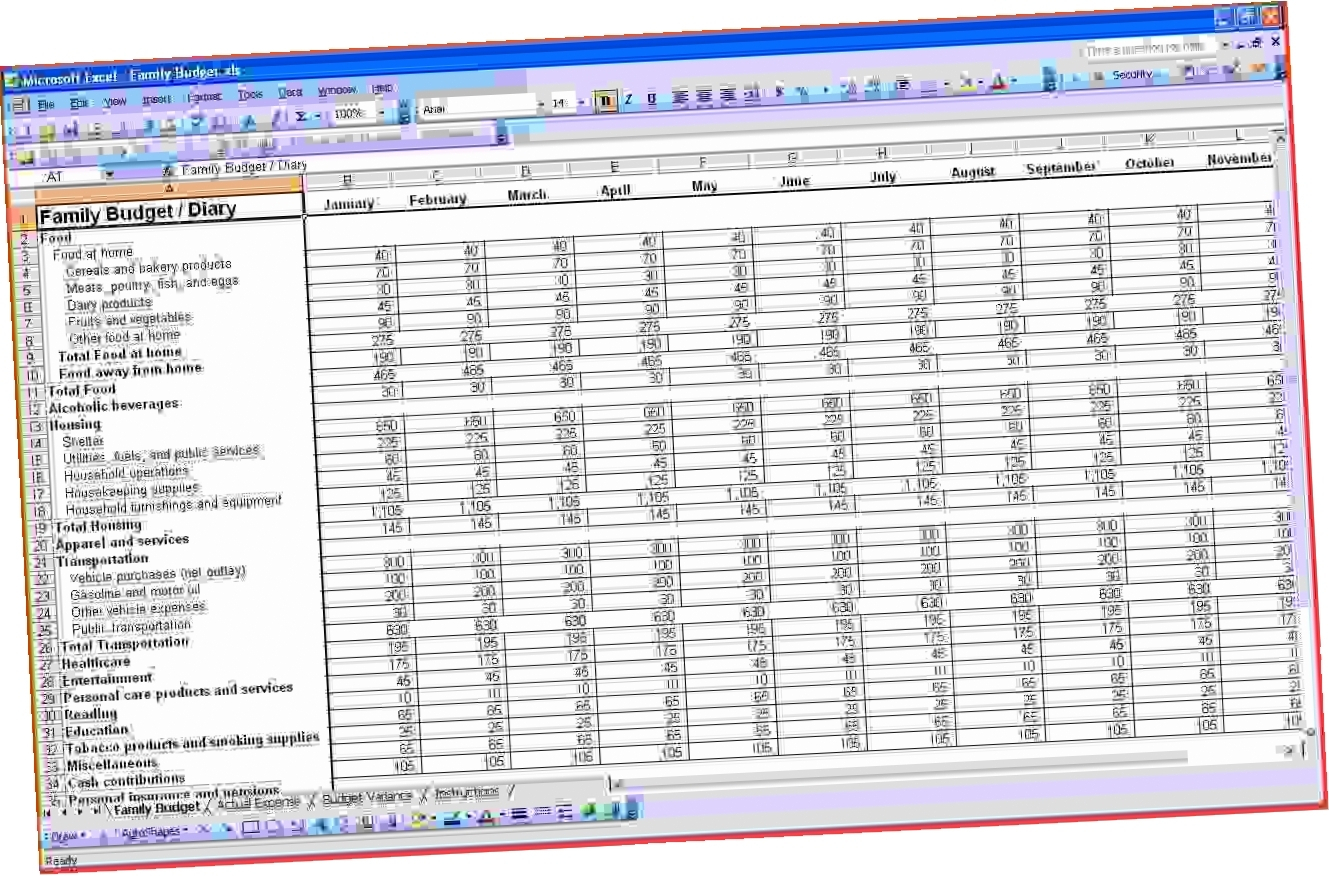

Small Business Bookkeeping Template Business Bookkeeping Spreadsheet

uk.pinterest.com

Small Business Bookkeeping Template Business Bookkeeping Spreadsheet …

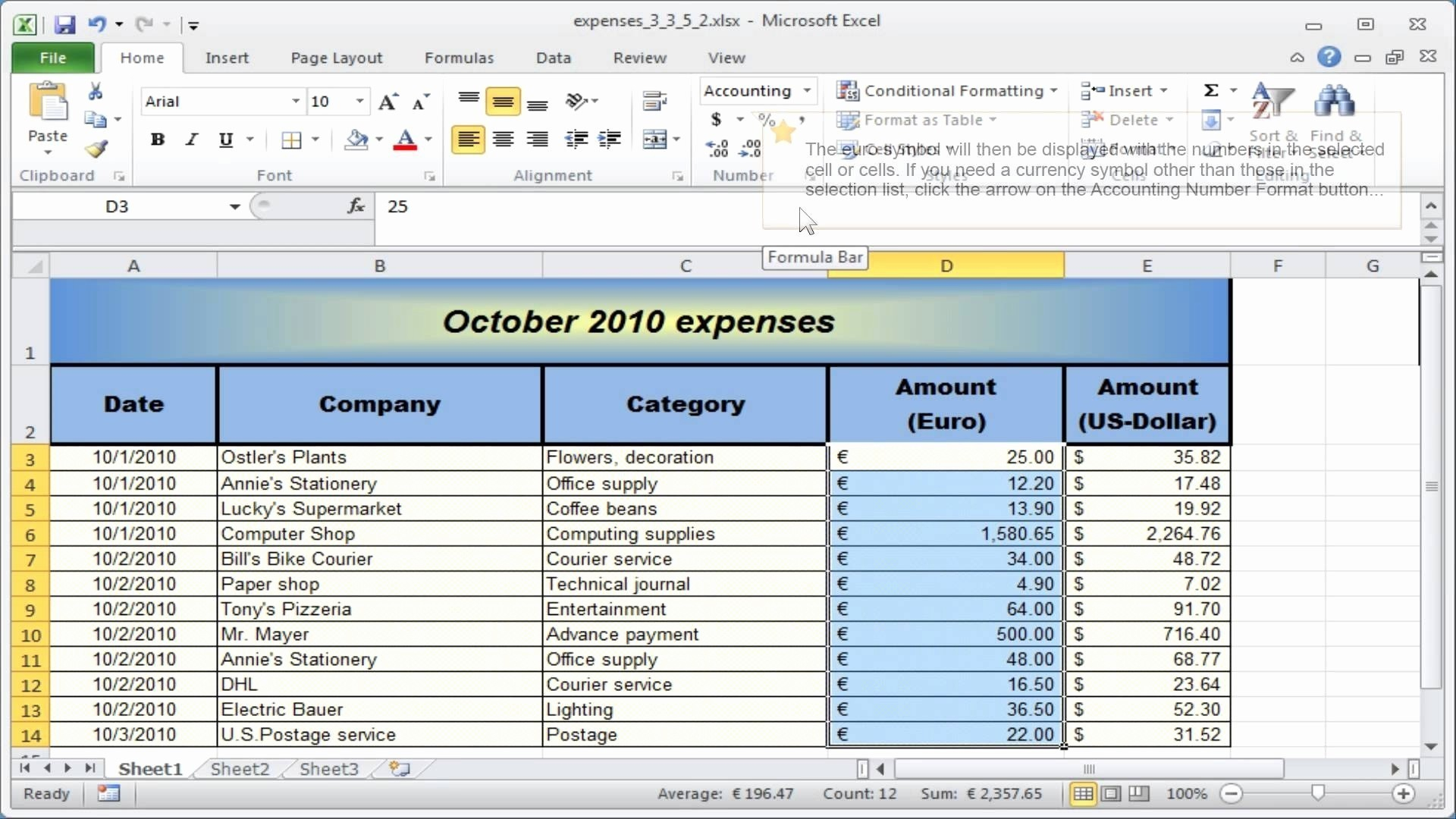

Excel Accounting And Bookkeeping (Template Included) | Bench For Excel

professional.fromgrandma.best

Excel Accounting And Bookkeeping (Template Included) | Bench for Excel …

Bookkeeping Templates For Small Business Save Small Business Within

db-excel.com

Bookkeeping Templates For Small Business Save Small Business within …

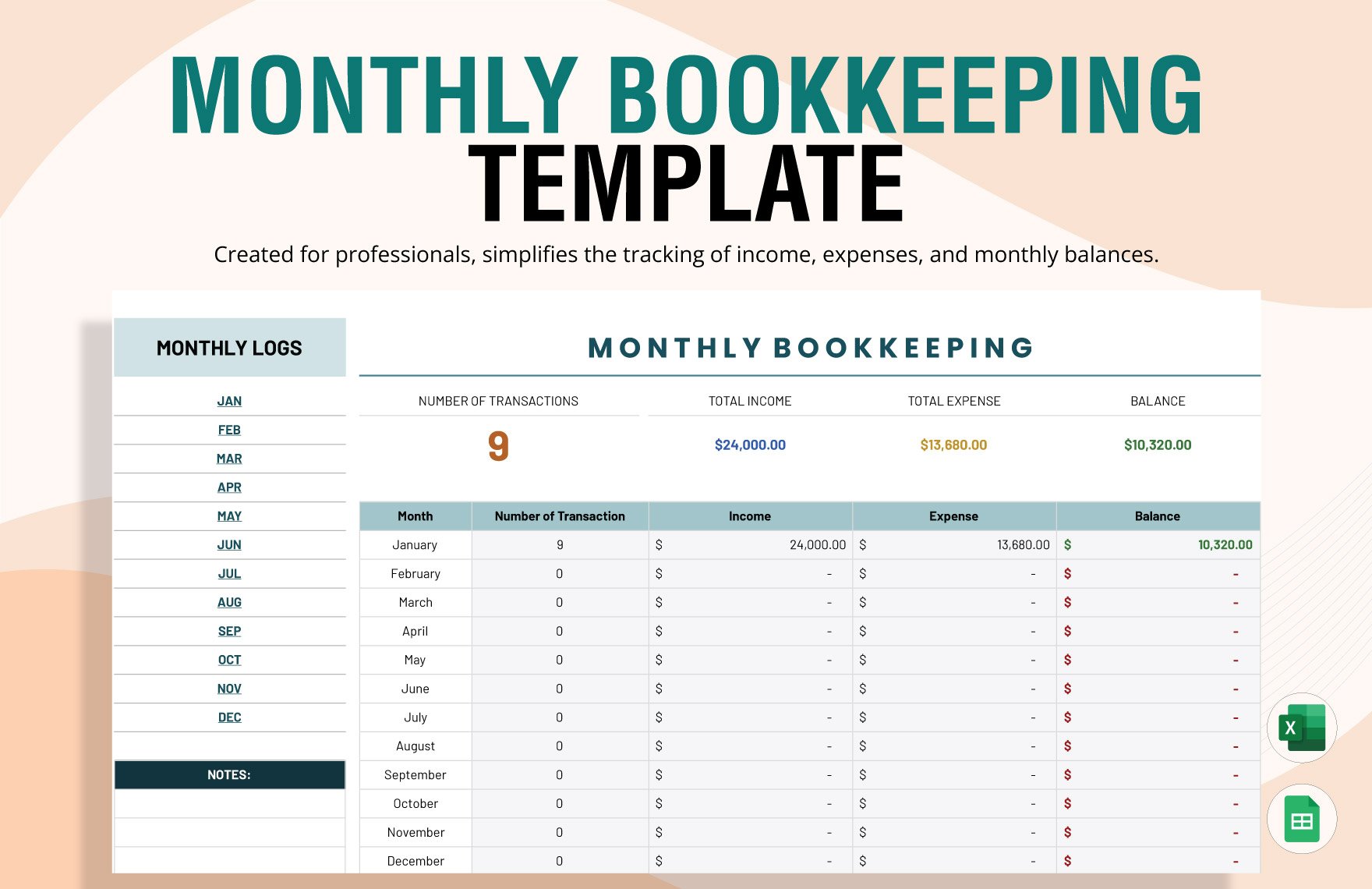

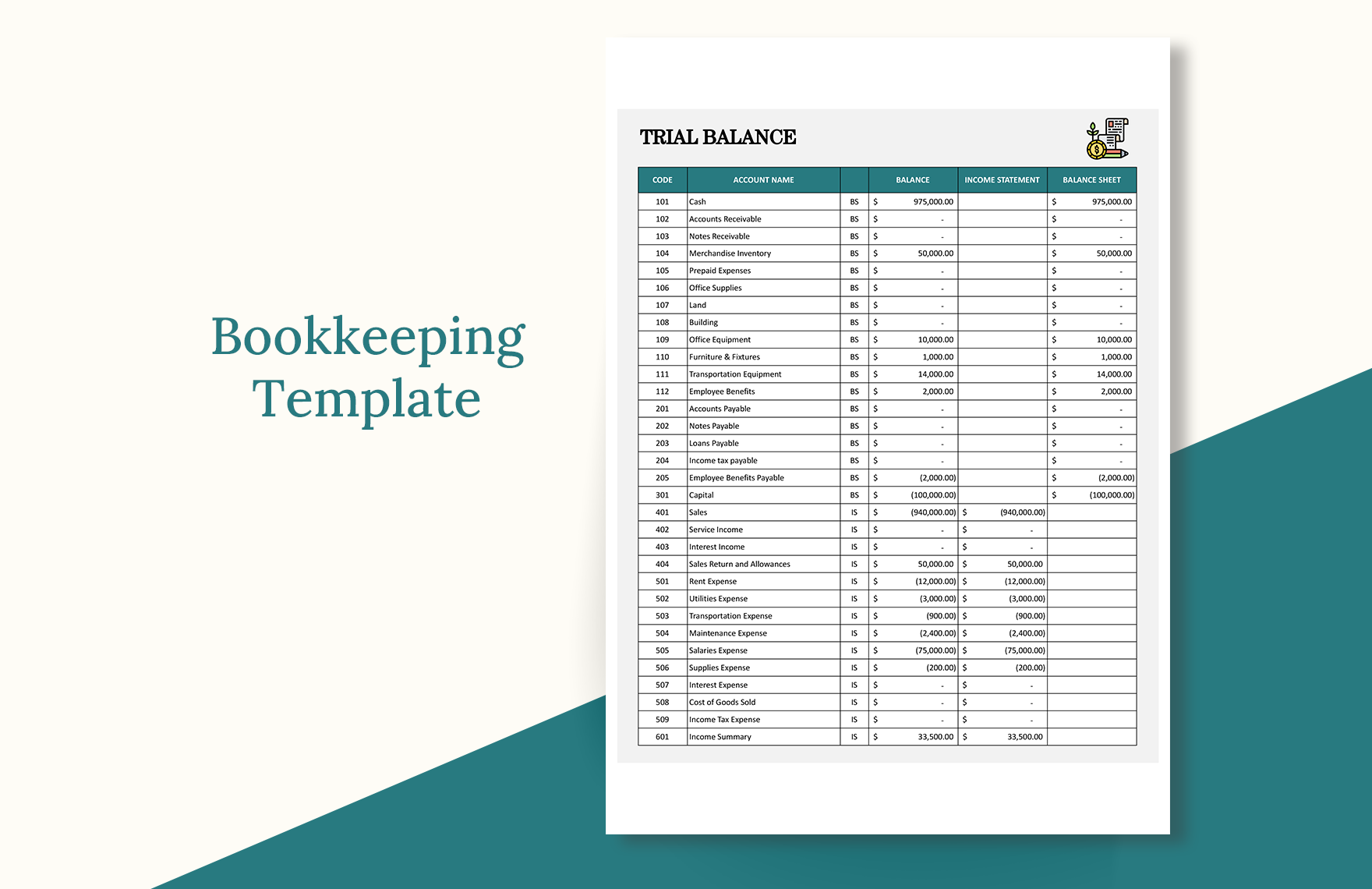

FREE Bookkeeping Template – Download In Google Docs, Excel, Google

www.template.net

FREE Bookkeeping Template – Download in Google Docs, Excel, Google …

Small Business Bookkeeping Spreadsheet Template In MS Excel, Google

www.template.net

Small Business Bookkeeping Spreadsheet Template in MS Excel, Google …

small business bookkeeping excel template. Free bookkeeping templates in excel to download. Free bookkeeping templates in excel to download