Starting a business is exciting, but turning your dream into a financially viable reality requires careful planning. A robust financial plan is your roadmap to success, helping you secure funding, manage cash flow, and make informed decisions. While crafting a comprehensive financial plan from scratch can seem daunting, utilizing a well-structured financial plan template can significantly simplify the process and ensure you cover all the necessary bases. This post will guide you through the key components of a financial plan template for a startup business and provide you with actionable insights to leverage it effectively.

What to Include in Your Startup’s Financial Plan Template

A good financial plan template should provide a framework for outlining your startup’s financial health and future projections. It should be adaptable to your specific industry and business model. Here’s a breakdown of the crucial sections to look for:

- Executive Summary: A concise overview of your business, its goals, and key financial highlights. Think of it as the elevator pitch for your financial projections. It should summarize your funding request, projected profitability, and key performance indicators (KPIs).

- Company Description: A detailed explanation of your business, including its mission, vision, and core values. This section also describes your products or services, target market, and competitive advantages.

- Market Analysis: A thorough examination of your target market, including its size, trends, and potential. Highlight your understanding of your customer base and your strategies for reaching them.

- Management Team: Introduce your team members, highlighting their experience and expertise. This section builds confidence in your ability to execute the business plan.

- Financial Projections: The heart of your financial plan, encompassing detailed forecasts of your revenue, expenses, and cash flow. This is where you demonstrate the viability of your business model.

- Funding Request (if applicable): Clearly state the amount of funding you are seeking, how you intend to use it, and the terms of your proposed deal.

Key Financial Statements in Your Template

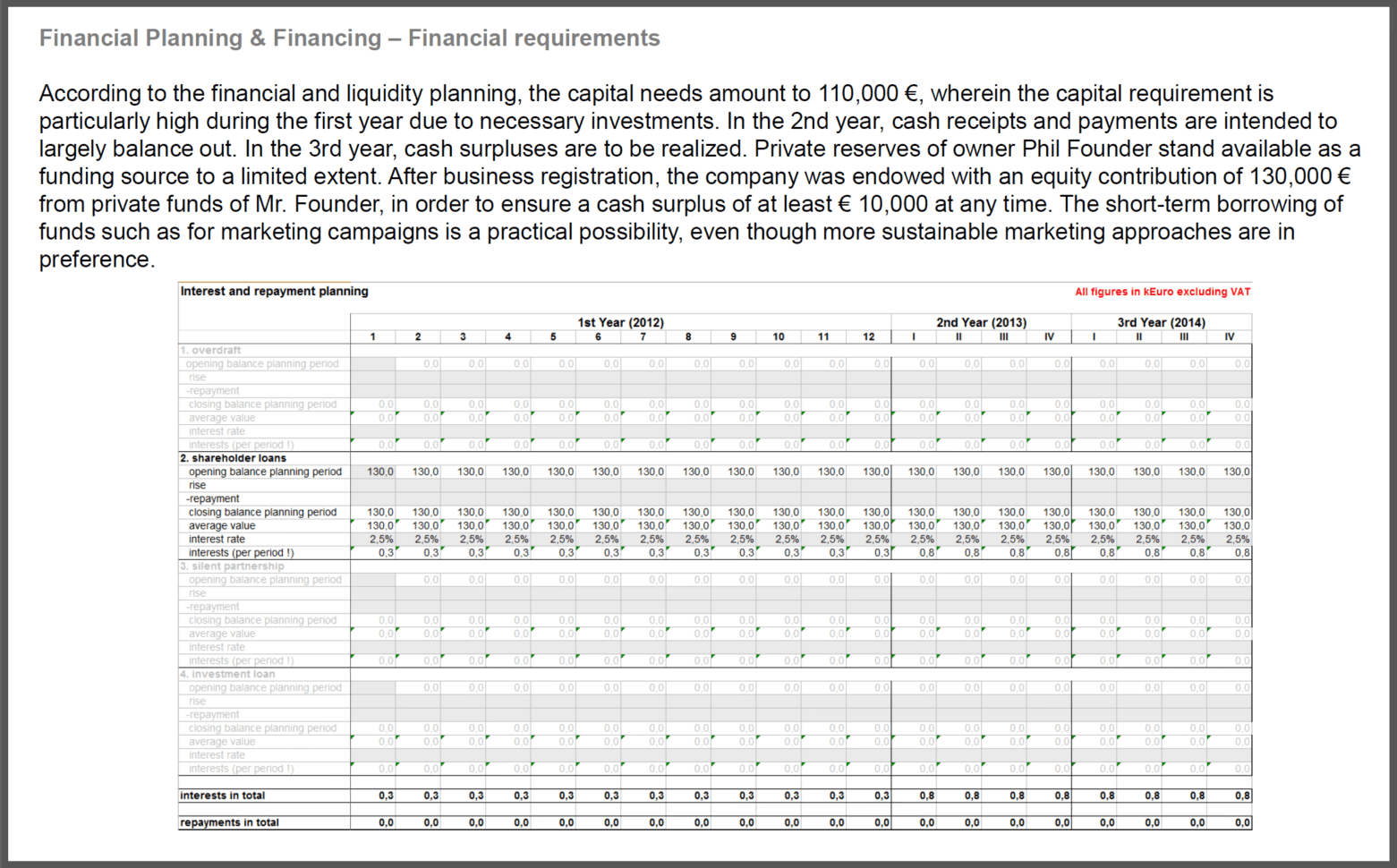

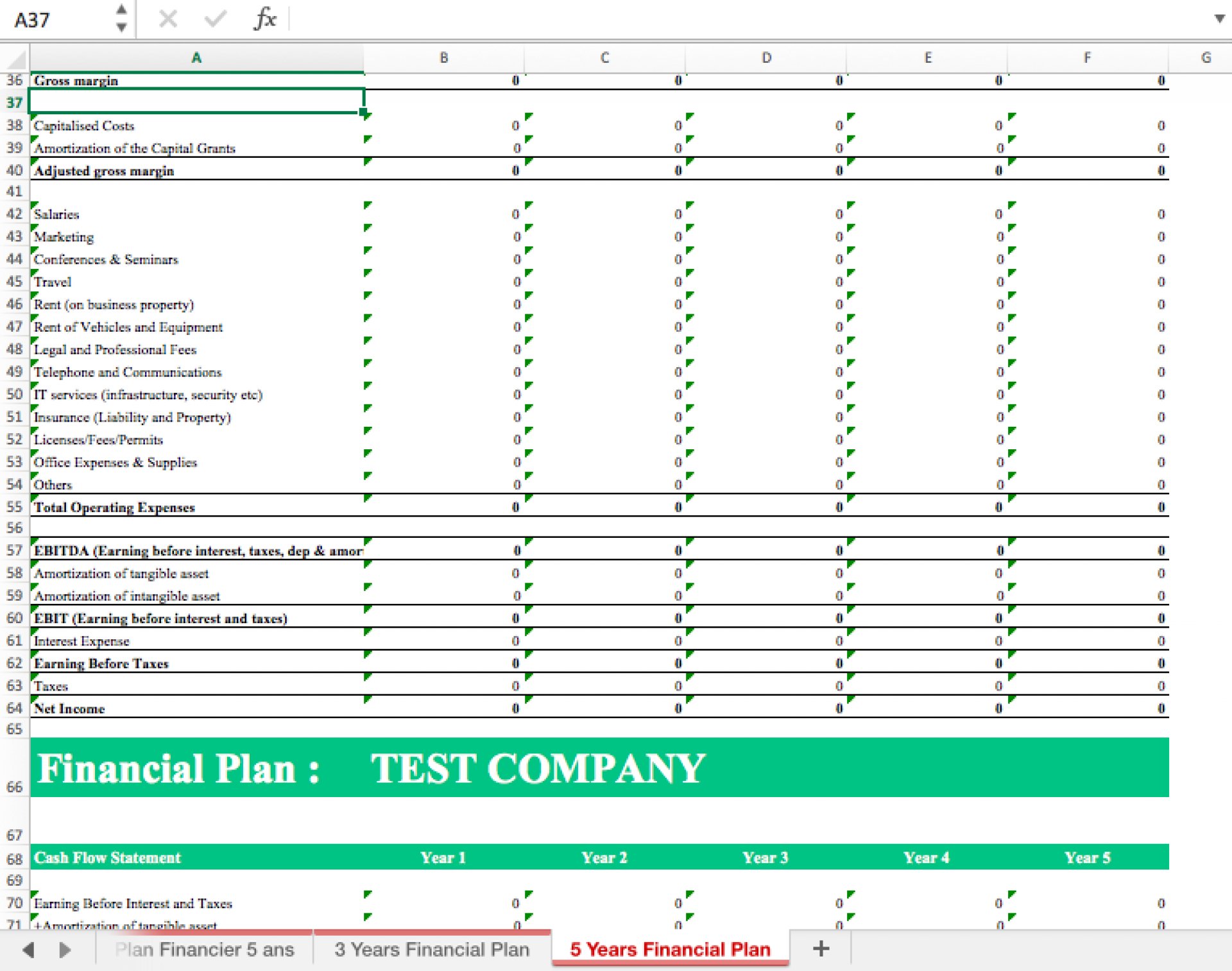

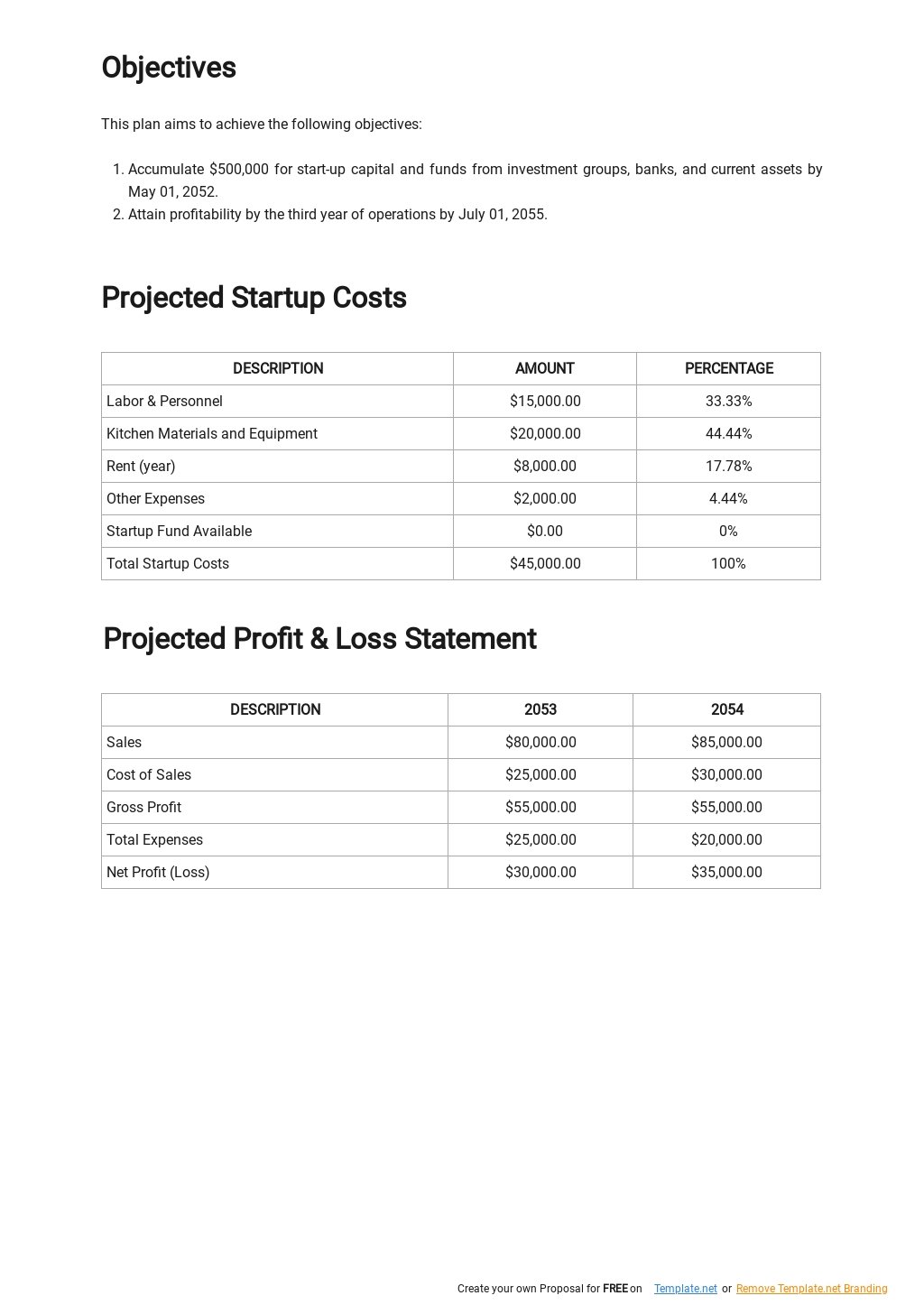

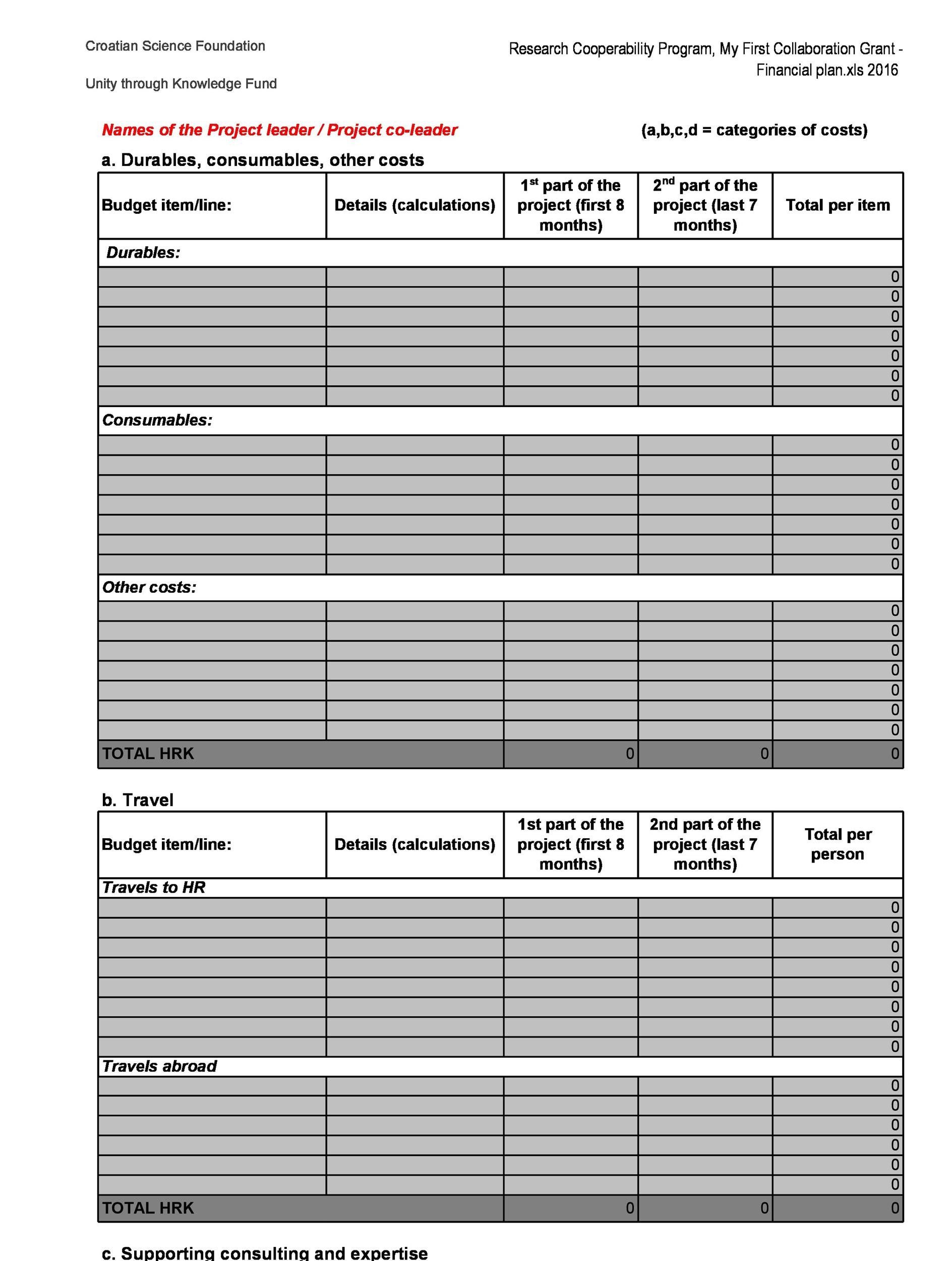

Your financial plan template should include these crucial financial statements, projected typically for at least 3-5 years:

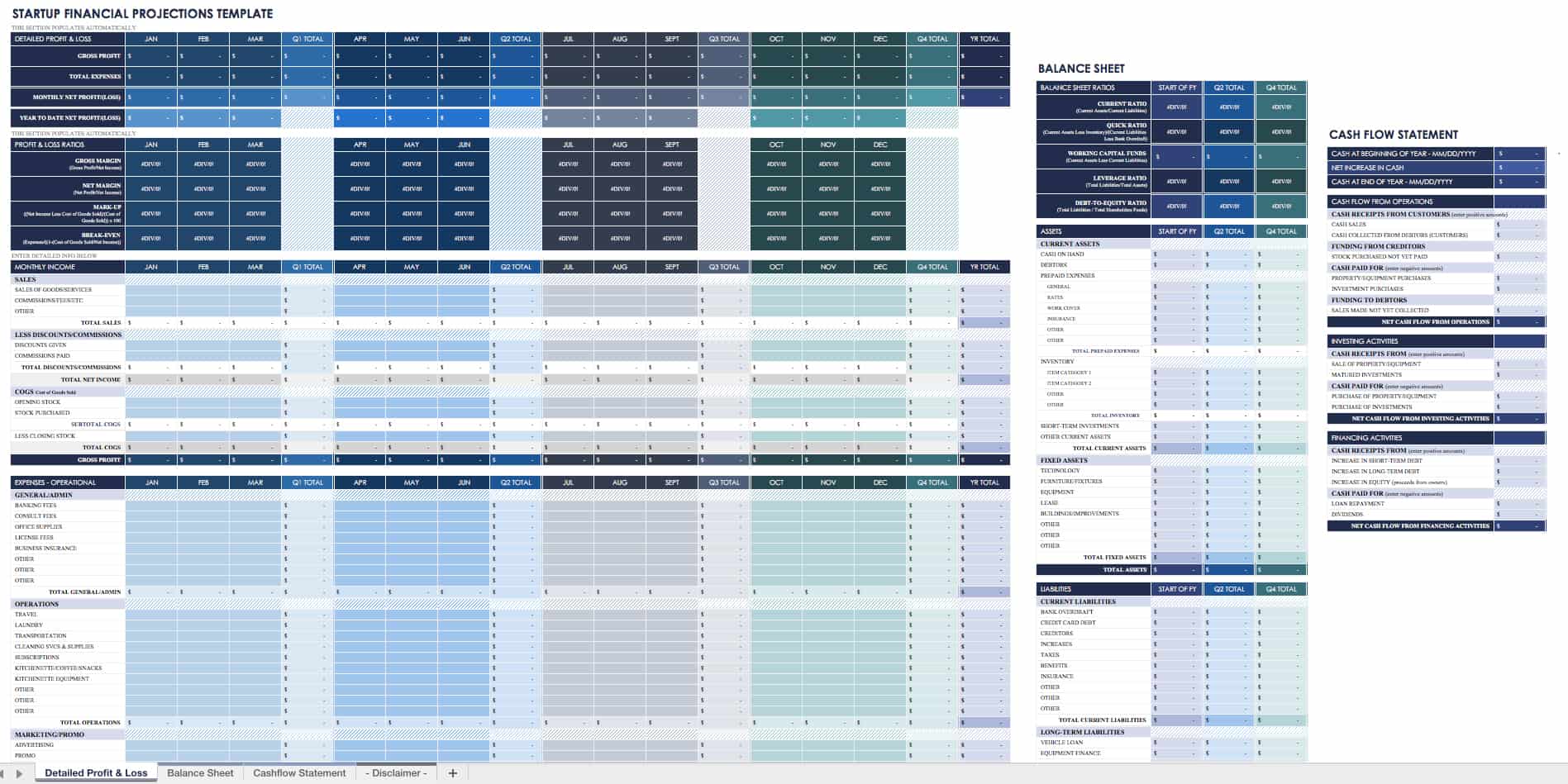

- Income Statement (Profit & Loss): This statement projects your revenues, expenses, and net income over a specific period. It shows your business’s profitability.

- Balance Sheet: This statement provides a snapshot of your company’s assets, liabilities, and equity at a specific point in time. It reflects your company’s financial position.

- Cash Flow Statement: This statement tracks the movement of cash in and out of your business, showing your ability to meet short-term obligations. It demonstrates your ability to manage liquidity.

- Startup Costs: A detailed breakdown of all the initial costs required to launch your business, including equipment, inventory, marketing, and legal fees.

- Break-Even Analysis: Determines the point at which your revenues equal your expenses, indicating the level of sales needed to achieve profitability.

- Key Assumptions: Clearly state the assumptions underpinning your financial projections, such as sales growth rates, cost of goods sold, and operating expenses. Transparency in your assumptions is crucial for credibility.

Using Your Financial Plan Template Effectively

Once you’ve chosen a suitable template, here are some tips for maximizing its effectiveness:

- Customize It: Don’t just fill in the blanks. Tailor the template to reflect your specific business model, industry, and market conditions.

- Be Realistic: Avoid overly optimistic projections. Base your assumptions on solid market research and realistic sales forecasts.

- Get Help: Don’t hesitate to seek advice from financial professionals, such as accountants or business advisors. They can provide valuable insights and help you refine your projections.

- Review Regularly: Your financial plan is not a static document. Review it regularly and update it as your business evolves. Compare your actual results to your projections and identify areas for improvement.

- Use it for Decision Making: Use your financial plan as a guiding tool for making important business decisions. It can help you assess the financial implications of different strategies and prioritize your resources.

A well-crafted financial plan template is an invaluable tool for any startup business. By carefully completing each section and regularly reviewing your plan, you can significantly increase your chances of success and build a sustainable, profitable business. Remember to prioritize realism, seek expert advice when needed, and adapt the template to your unique circumstances.

If you are searching about Startup Financial Plan Template – Templarket.com you’ve visit to the right page. We have 9 Pictures about Startup Financial Plan Template – Templarket.com like Startup Financial Plan Template, Free Financial Plan Template For Startup Business and also Startup Financial Plan Template – Edit Online & Download Example. Here you go:

Startup Financial Plan Template – Templarket.com

www.templarket.com

Startup Financial Plan Template

template.mapadapalavra.ba.gov.br

Financial Plan Template For Startup Business – PARAHYENA

www.parahyena.com

Free Financial Plan Template For Startup Business

template.mapadapalavra.ba.gov.br

Financial Plan For Startup Business Template Pdf – PDF Template

templatepdf.blogspot.com

startup previews chapters

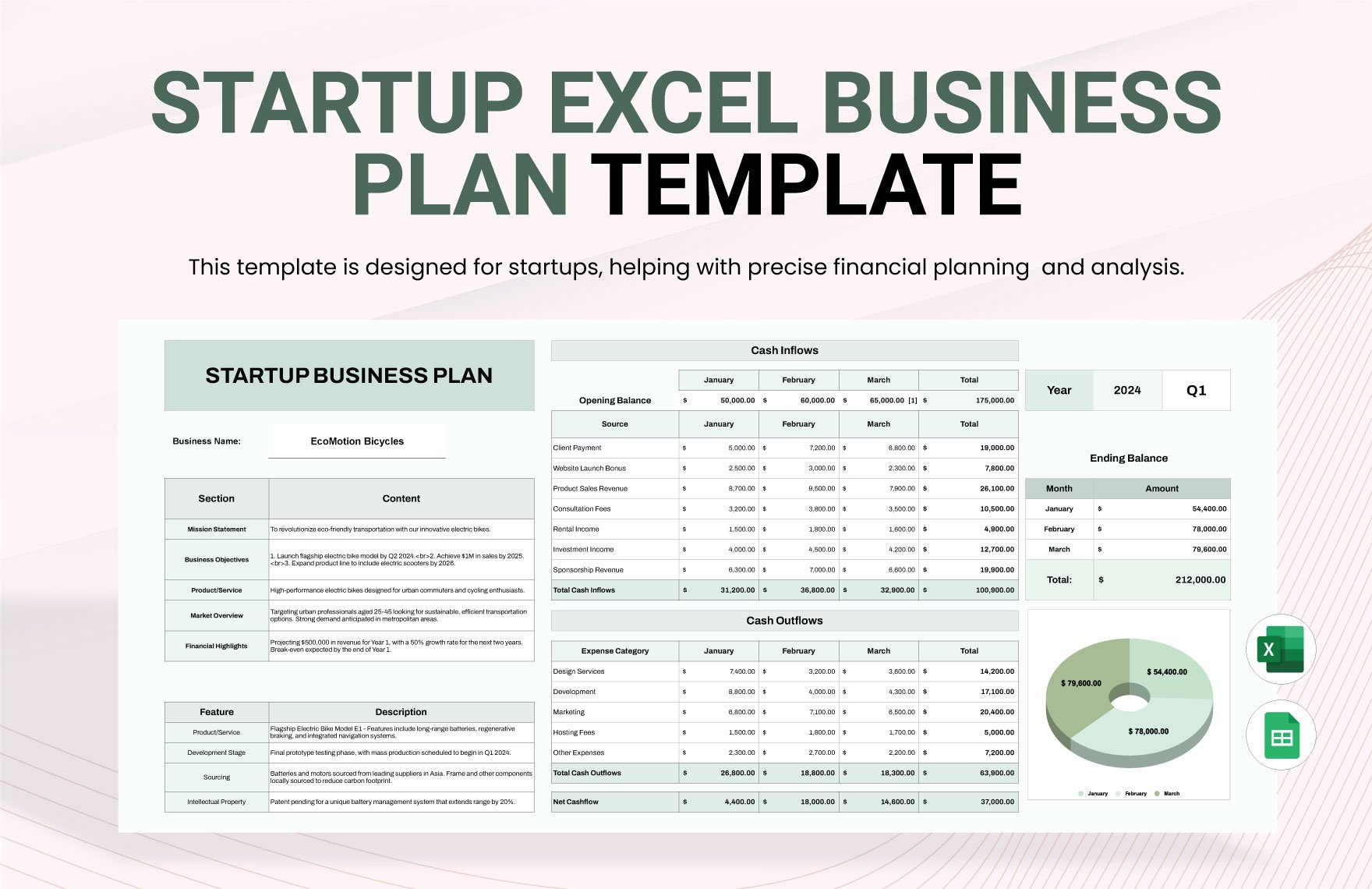

Startup Excel Business Plan Template | Template.net

www.template.net

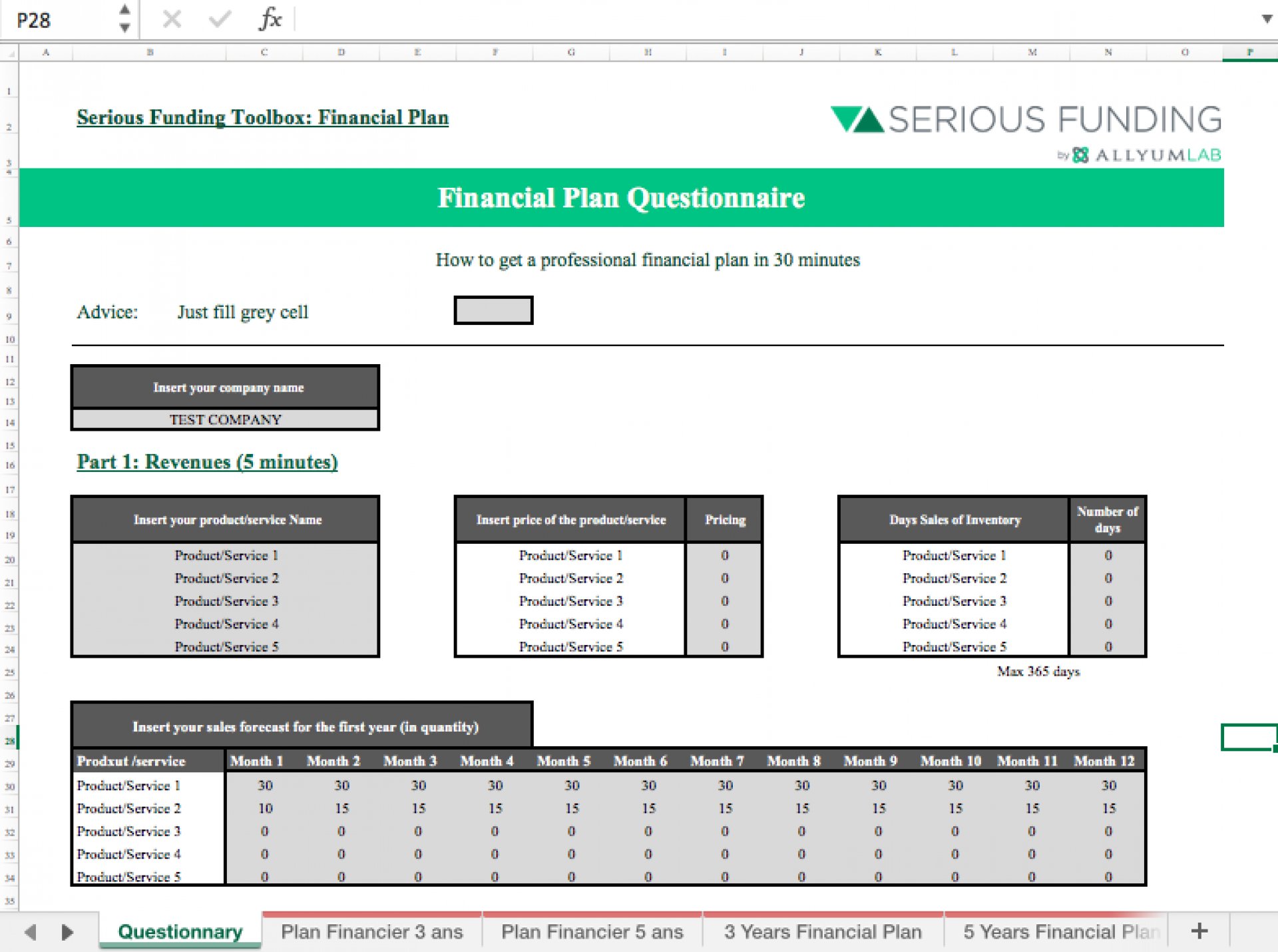

Startup Financial Plan Template – Eloquens

www.eloquens.com

Financial Plan Template For Startup Business – PARAHYENA

www.parahyena.com

Startup Financial Plan Template – Edit Online & Download Example

www.template.net

Startup financial plan template. Free financial plan template for startup business. Financial plan template for startup business – parahyena