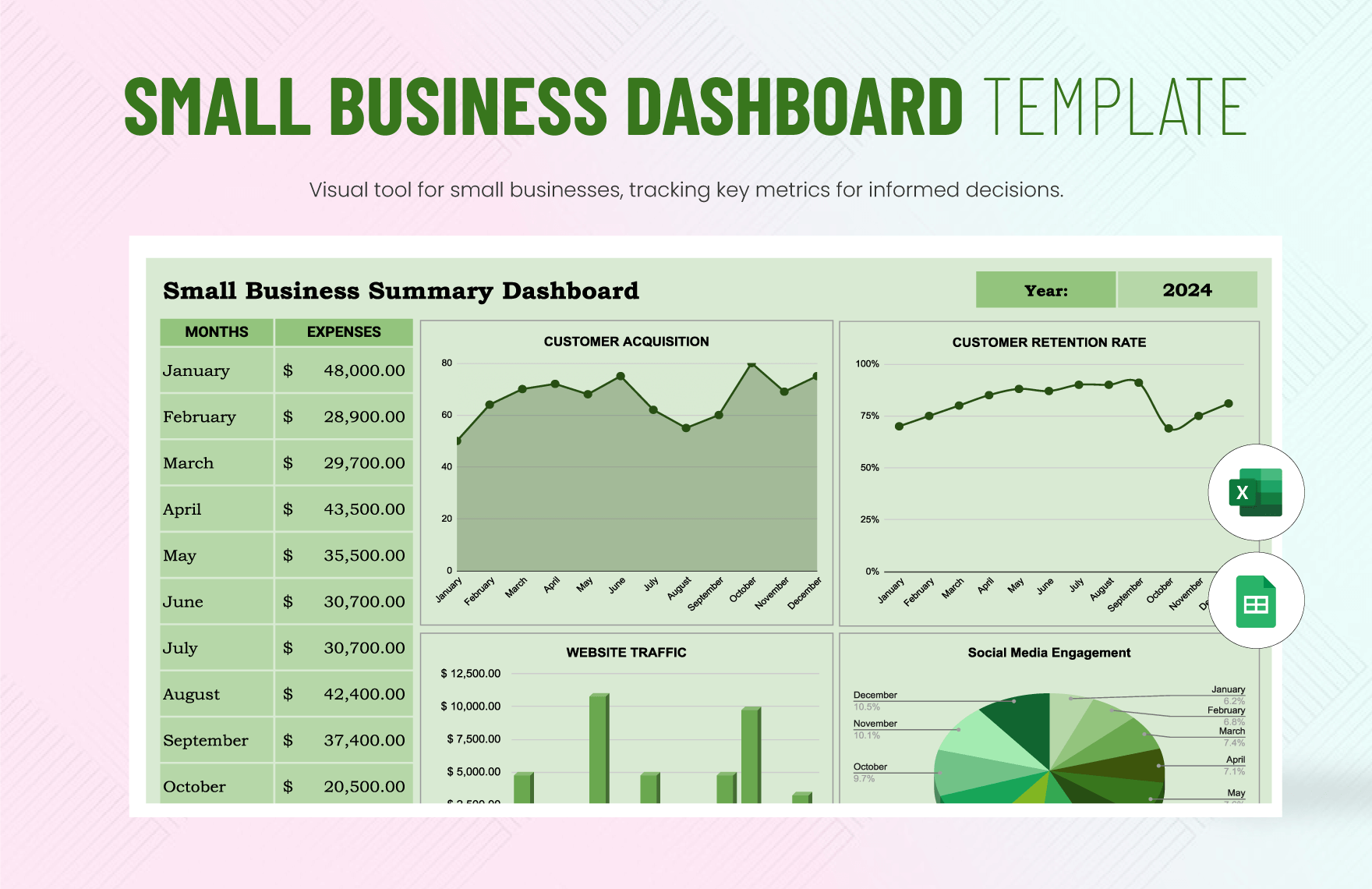

Running a small business is a whirlwind of excitement, challenges, and, of course, numbers. Keeping track of your finances can feel like a daunting task, especially when you’re wearing all the hats – from CEO to marketing manager. Fortunately, you don’t need fancy (and expensive!) accounting software right away. Excel templates can be a fantastic starting point for managing your small business’s financial records. They offer a cost-effective and user-friendly solution to organize your data, track expenses, and gain valuable insights into your company’s financial health. They provide structure and automation, saving you time and effort compared to manual bookkeeping.

Why Excel Templates for Small Business Accounting?

Before diving into the specific templates, let’s explore why they are a valuable tool for small businesses:

- Cost-Effective: As mentioned, Excel or a similar spreadsheet program is often already installed on your computer. This means you can avoid the upfront and recurring costs associated with dedicated accounting software.

- User-Friendly: Most business owners have some familiarity with Excel. Templates build on that familiarity, making them easier to learn and use than complex software packages.

- Customizable: You can easily modify templates to suit the specific needs of your business. Add or remove columns, change formulas, and tailor the template to your unique requirements.

- Accessible: Excel files can be easily shared with accountants, business partners, or investors, facilitating collaboration and transparency.

- Scalable (to a Point): While Excel templates might not be a long-term solution for rapidly growing businesses, they provide a solid foundation for managing your finances in the early stages.

However, it’s important to acknowledge the limitations. As your business grows and transactions become more complex, you’ll likely need to upgrade to a more robust accounting system. Excel lacks the security features and advanced reporting capabilities of dedicated software, and manual data entry can become time-consuming and prone to errors.

Essential Excel Templates for Your Small Business

Here’s a breakdown of some key Excel templates that can streamline your small business accounting:

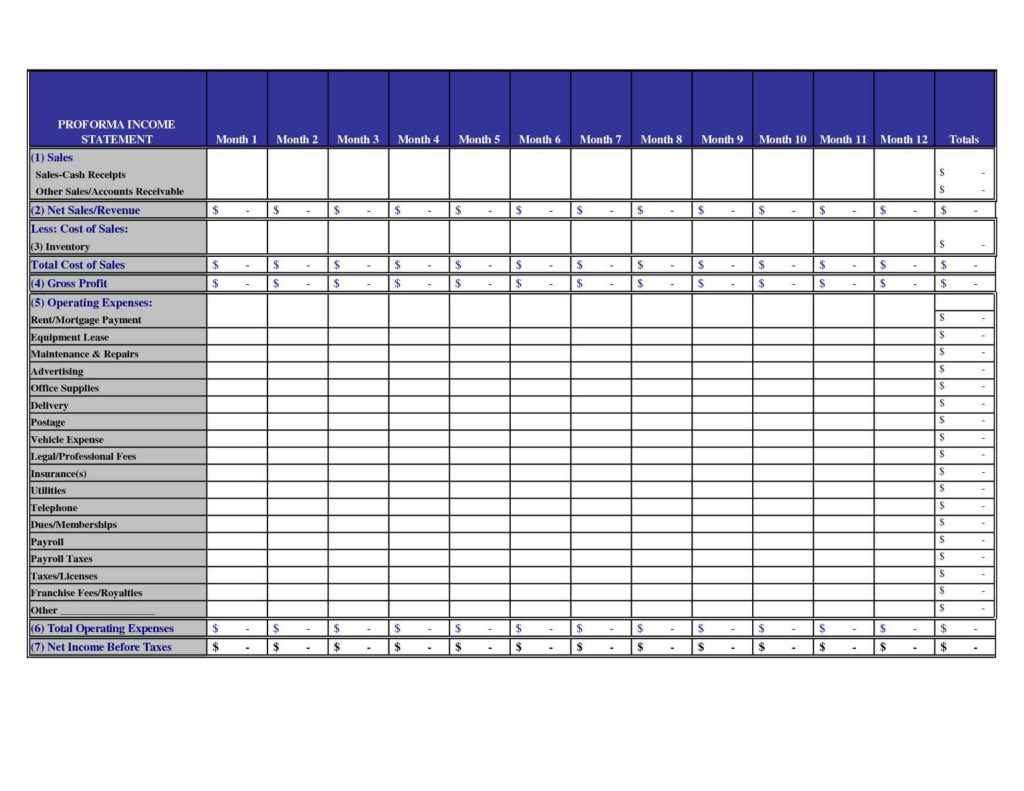

1. Profit and Loss (P&L) Statement Template

This template is crucial for understanding your business’s profitability over a specific period (monthly, quarterly, or annually). It summarizes your revenues, expenses, and ultimately calculates your net profit or loss. A well-designed P&L template will automatically calculate key ratios like gross profit margin and net profit margin, providing insights into your business’s efficiency and performance.

- Sections: Revenue, Cost of Goods Sold (COGS), Gross Profit, Operating Expenses, Operating Income, Interest Expense, Income Taxes, Net Income.

- Benefits: Provides a clear overview of your profitability, helps identify areas for cost reduction, and facilitates financial analysis.

- Key Metrics: Gross Profit Margin, Net Profit Margin, Operating Income.

2. Cash Flow Statement Template

This template tracks the movement of cash into and out of your business. It categorizes cash flows into three activities: operating, investing, and financing. Understanding your cash flow is vital for managing your working capital and ensuring you have enough cash on hand to meet your obligations. A cash flow statement differs from a P&L statement as it focuses on actual cash transactions, not just reported income or expenses.

- Sections: Cash Flow from Operating Activities, Cash Flow from Investing Activities, Cash Flow from Financing Activities, Net Increase/Decrease in Cash, Beginning Cash Balance, Ending Cash Balance.

- Benefits: Helps manage cash flow, identify potential cash shortages, and make informed investment decisions.

- Key Metrics: Operating Cash Flow, Free Cash Flow.

3. Balance Sheet Template

The balance sheet provides a snapshot of your company’s assets, liabilities, and equity at a specific point in time. It follows the fundamental accounting equation: Assets = Liabilities + Equity. This template helps you assess your company’s financial position and solvency. It shows what your business owns (assets), what it owes (liabilities), and the owner’s stake in the business (equity).

- Sections: Assets (Current and Non-Current), Liabilities (Current and Non-Current), Equity.

- Benefits: Provides a snapshot of your financial health, reveals debt levels, and assesses the value of your business.

- Key Metrics: Debt-to-Equity Ratio, Current Ratio, Quick Ratio.

4. Invoice Template

A professional invoice template is essential for getting paid on time. It should include your company’s logo, contact information, a unique invoice number, the customer’s details, a description of the goods or services provided, the price, and the payment terms. Using a consistent invoice template ensures a professional image and simplifies the billing process.

- Sections: Company Information, Customer Information, Invoice Number, Date, Description of Goods/Services, Quantity, Unit Price, Total Amount, Payment Terms.

- Benefits: Creates professional invoices, tracks outstanding payments, and simplifies the billing process.

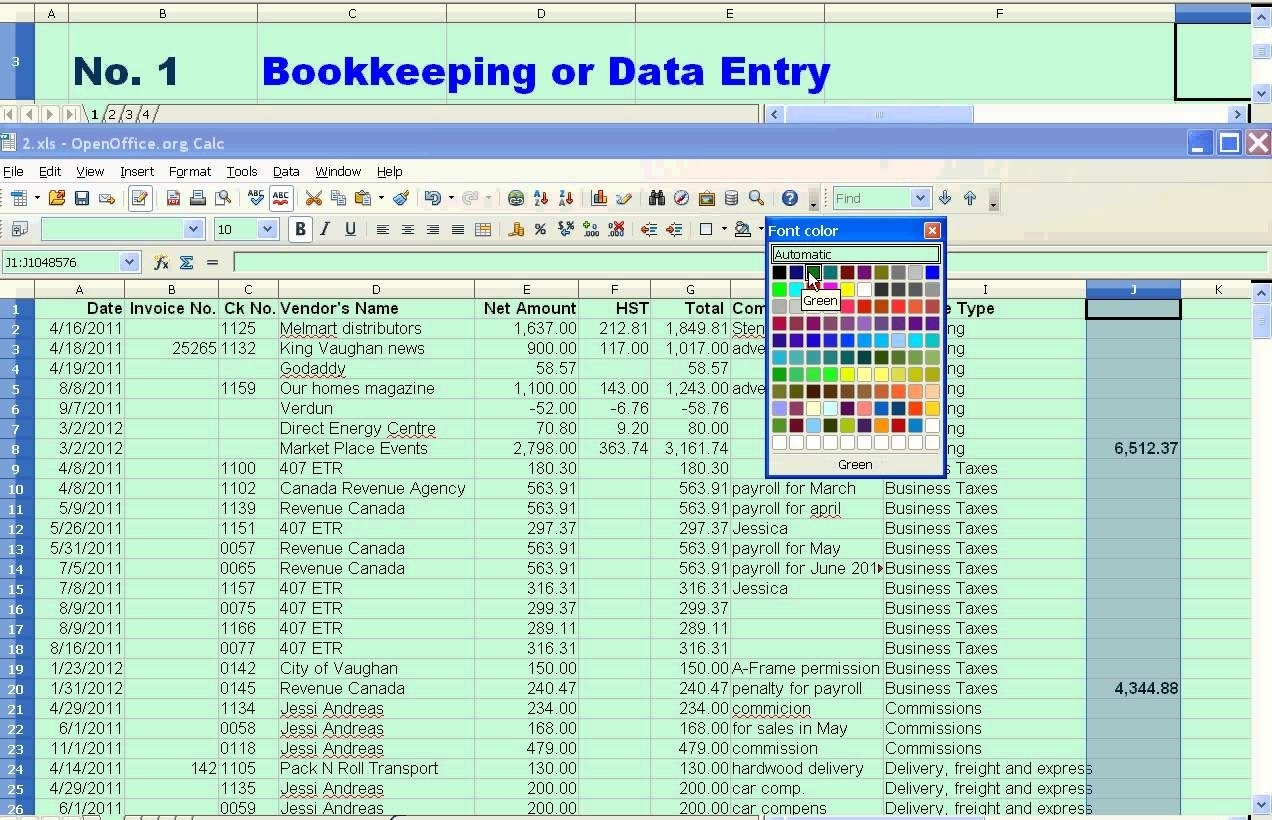

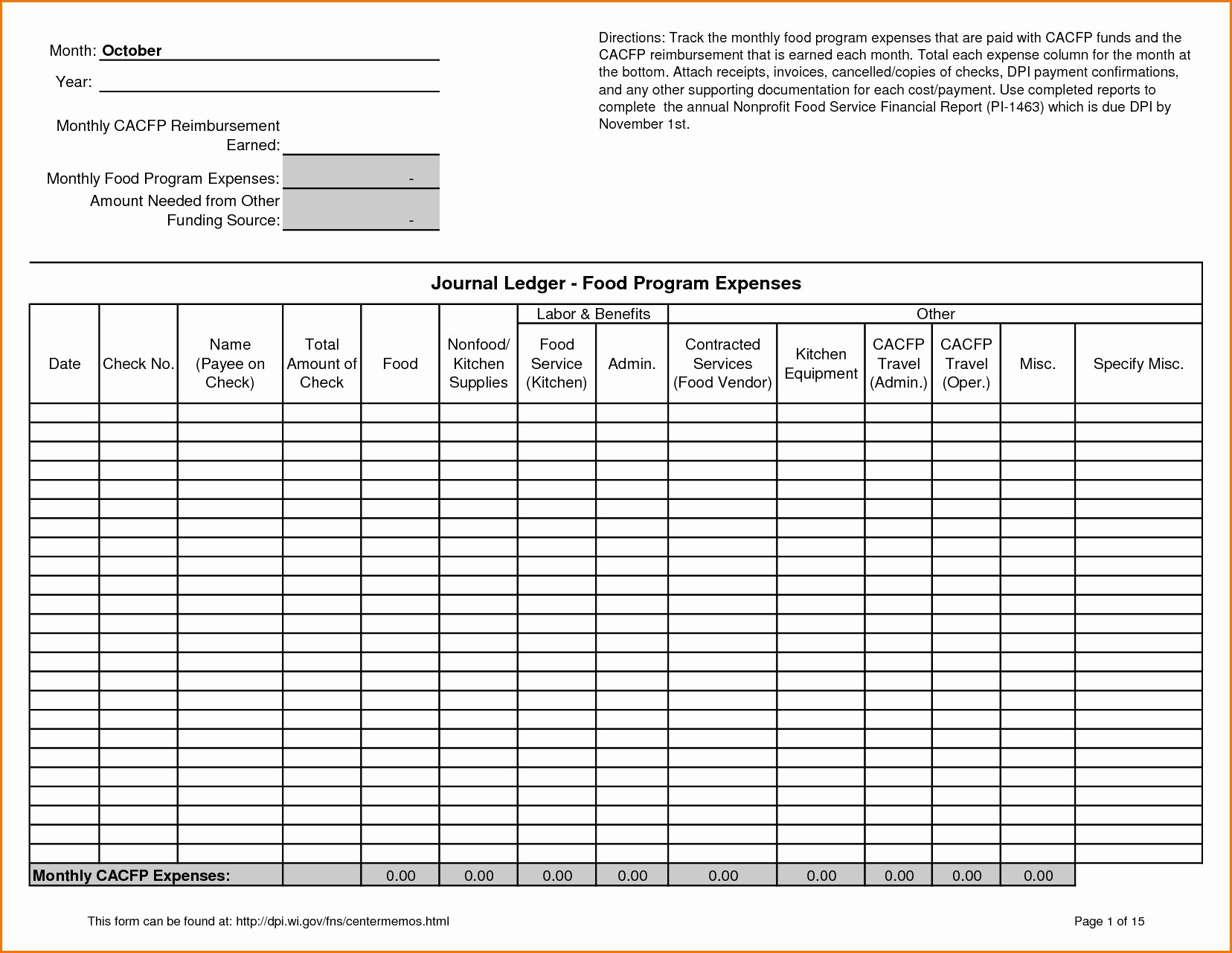

5. Expense Tracking Template

This template helps you track all your business expenses, categorized by type (e.g., rent, utilities, marketing). It’s critical for accurately calculating your profits and for tax purposes. By monitoring your expenses, you can identify areas where you can cut costs and improve your bottom line.

- Sections: Date, Vendor, Description, Category, Payment Method, Amount.

- Benefits: Tracks expenses for tax purposes, identifies areas for cost reduction, and simplifies budgeting.

In conclusion, Excel templates can be an invaluable asset for small business accounting, providing a cost-effective and user-friendly way to manage your finances. While they may not be a permanent solution for every business, they are an excellent starting point for gaining control of your finances and making informed business decisions. Remember to choose templates that suit your specific needs and to regularly update your data to ensure accurate financial reporting.

If you are looking for Accounting Plan Templates in Excel – FREE Download | Template.net you’ve came to the right web. We have 9 Pictures about Accounting Plan Templates in Excel – FREE Download | Template.net like small business accounting templates excel — db-excel.com, Excel Template For Small Business Bookkeeping | Ariel Assistance with and also Excel Accounting Template For Small Business Spreadsheet Templates for. Read more:

Accounting Plan Templates In Excel – FREE Download | Template.net

www.template.net

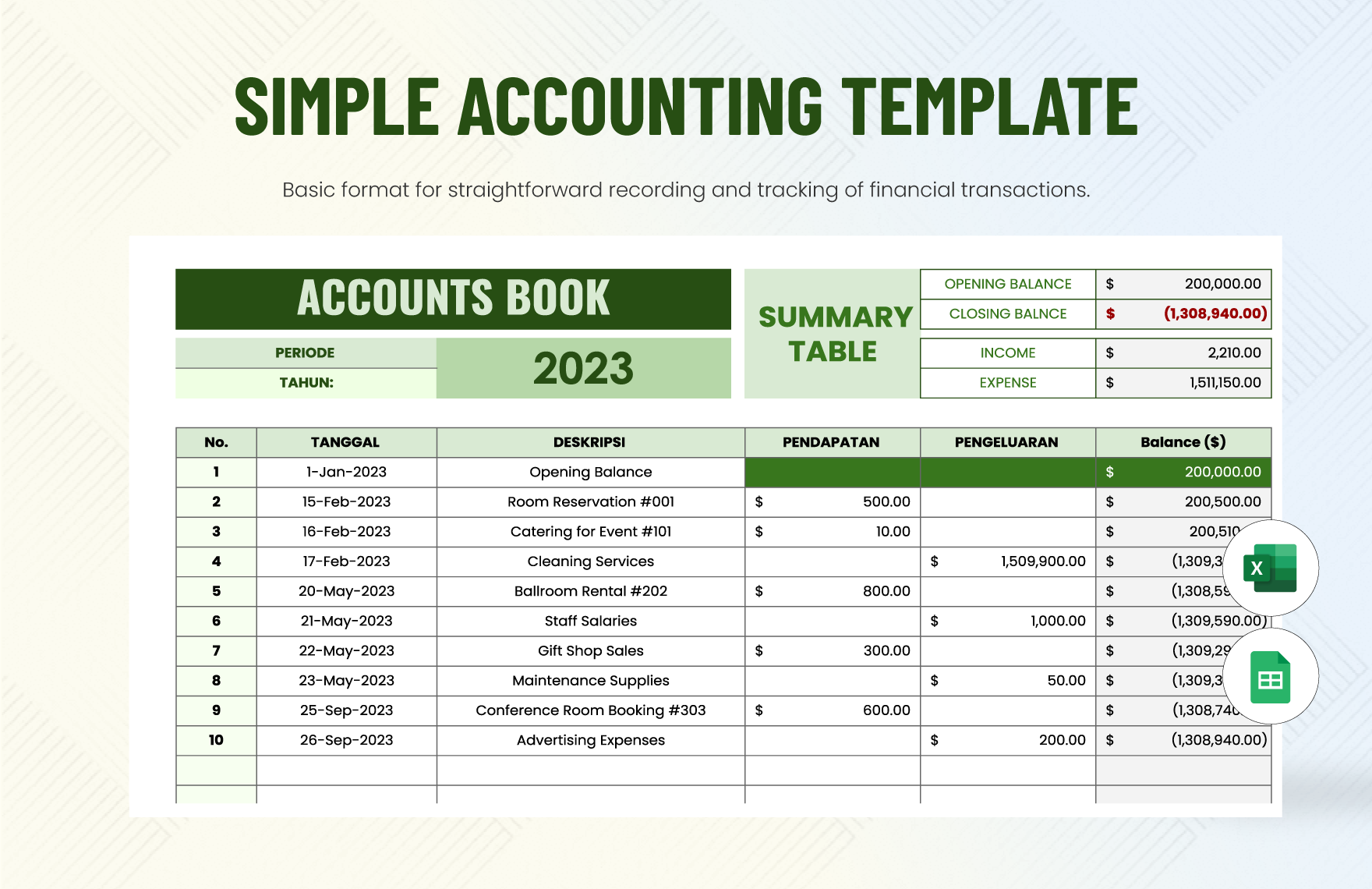

Small Business Accounting Templates Excel — Db-excel.com

db-excel.com

accounting business small excel templates template spreadsheet db

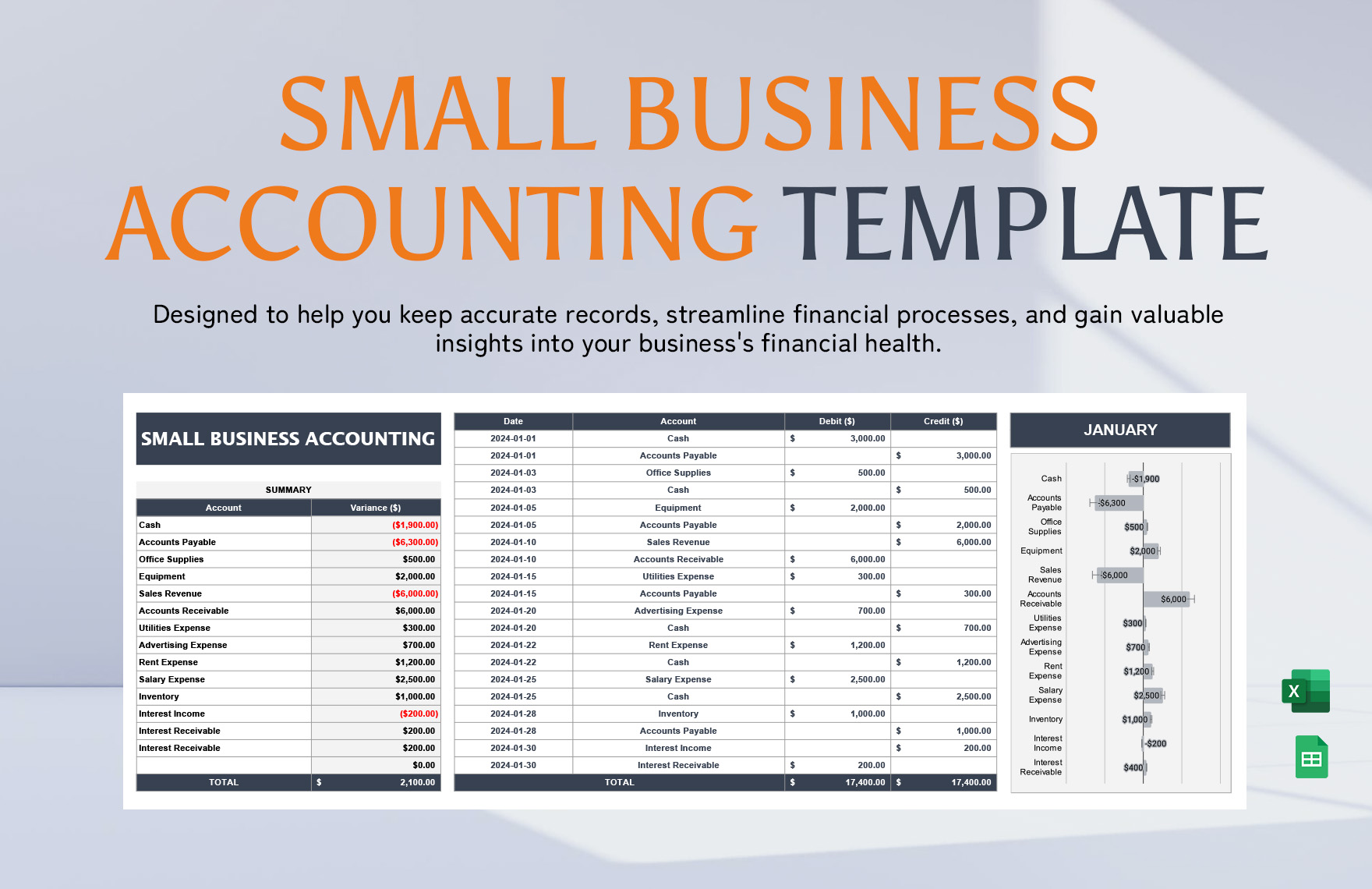

Editable Small Business Templates In Excel To Download

www.template.net

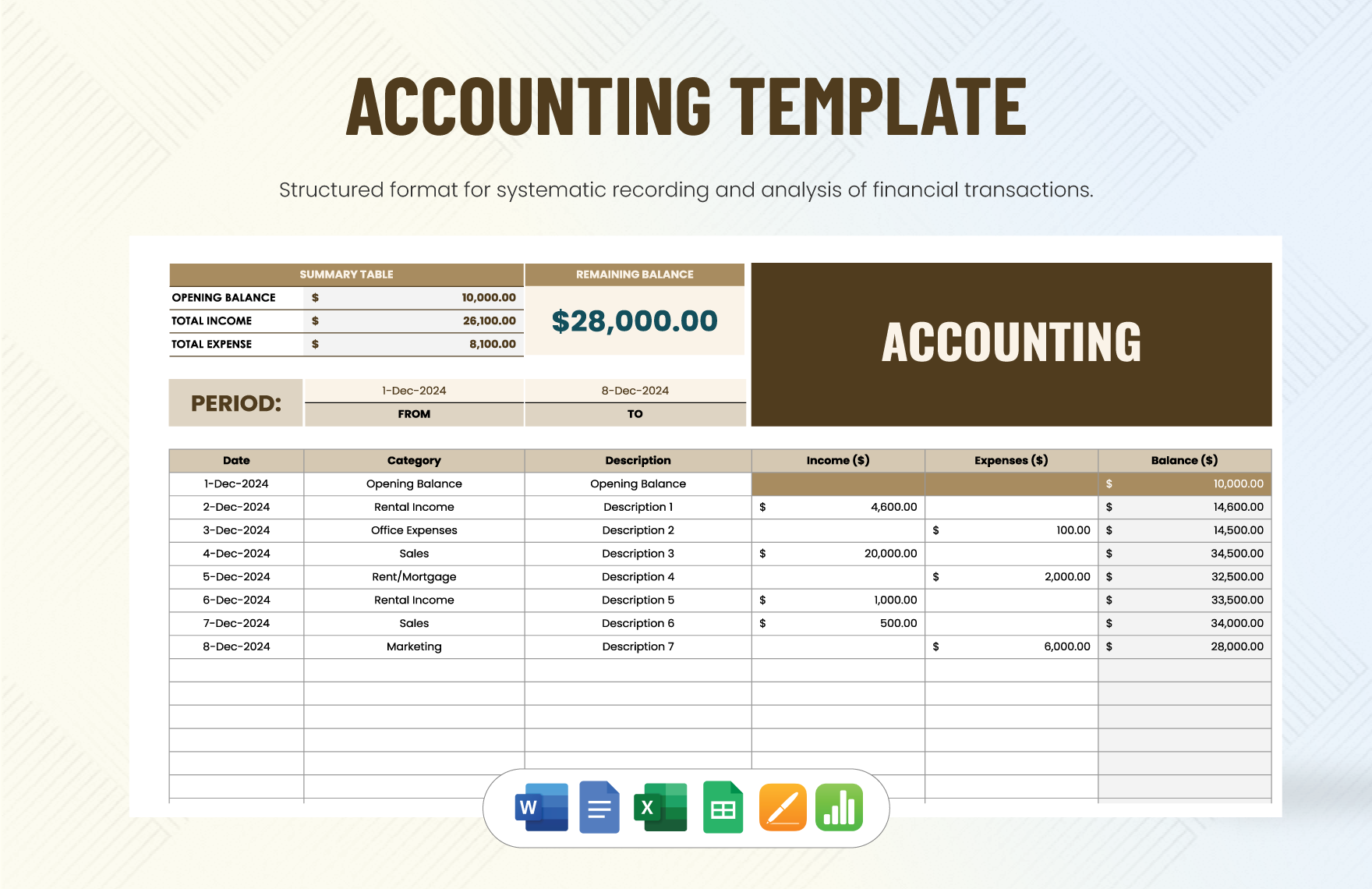

Editable Accounting Templates In Excel To Download

www.template.net

Excel Template For Small Business Bookkeeping | Ariel Assistance With

db-excel.com

accounting business excel templates small template bookkeeping assistance ariel db

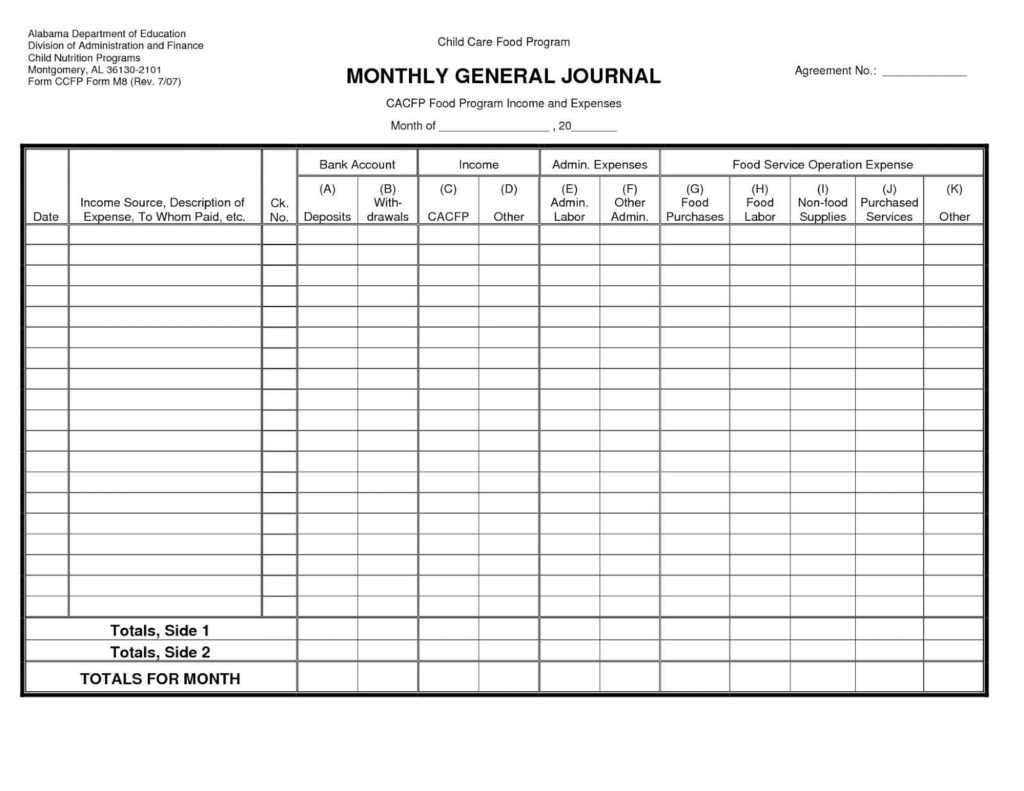

Excel Accounting Template For Small Business Spreadsheet Templates For

db-excel.com

excel spreadsheet template accounting business templates rent small bookkeeping collection monthly accounts cost food ledger payable church forms form calculator

Editable Small Business Templates In Excel To Download

www.template.net

Accounting Spreadsheet Template For Small Business — Db-excel.com

db-excel.com

spreadsheet excel template self expense business employed small templates profit loss accounting statement income report sheet form sample expenses operating

Small Business Bookkeeping Template Business Bookkeeping Spreadsheet

uk.pinterest.com

Small business bookkeeping template business bookkeeping spreadsheet. Editable small business templates in excel to download. Spreadsheet excel template self expense business employed small templates profit loss accounting statement income report sheet form sample expenses operating