Managing your finances effectively requires a keen understanding of your spending habits. One of the most valuable tools for achieving this is your credit card statement. However, deciphering a credit card statement can sometimes feel like navigating a complex maze. A clear and organized credit card statement template can significantly simplify this process, allowing you to easily track your transactions, monitor your spending, and avoid potential issues like fraud or overspending. This post delves into the components of a well-structured credit card statement template and how you can use it to your advantage.

Understanding Your Credit Card Statement Template

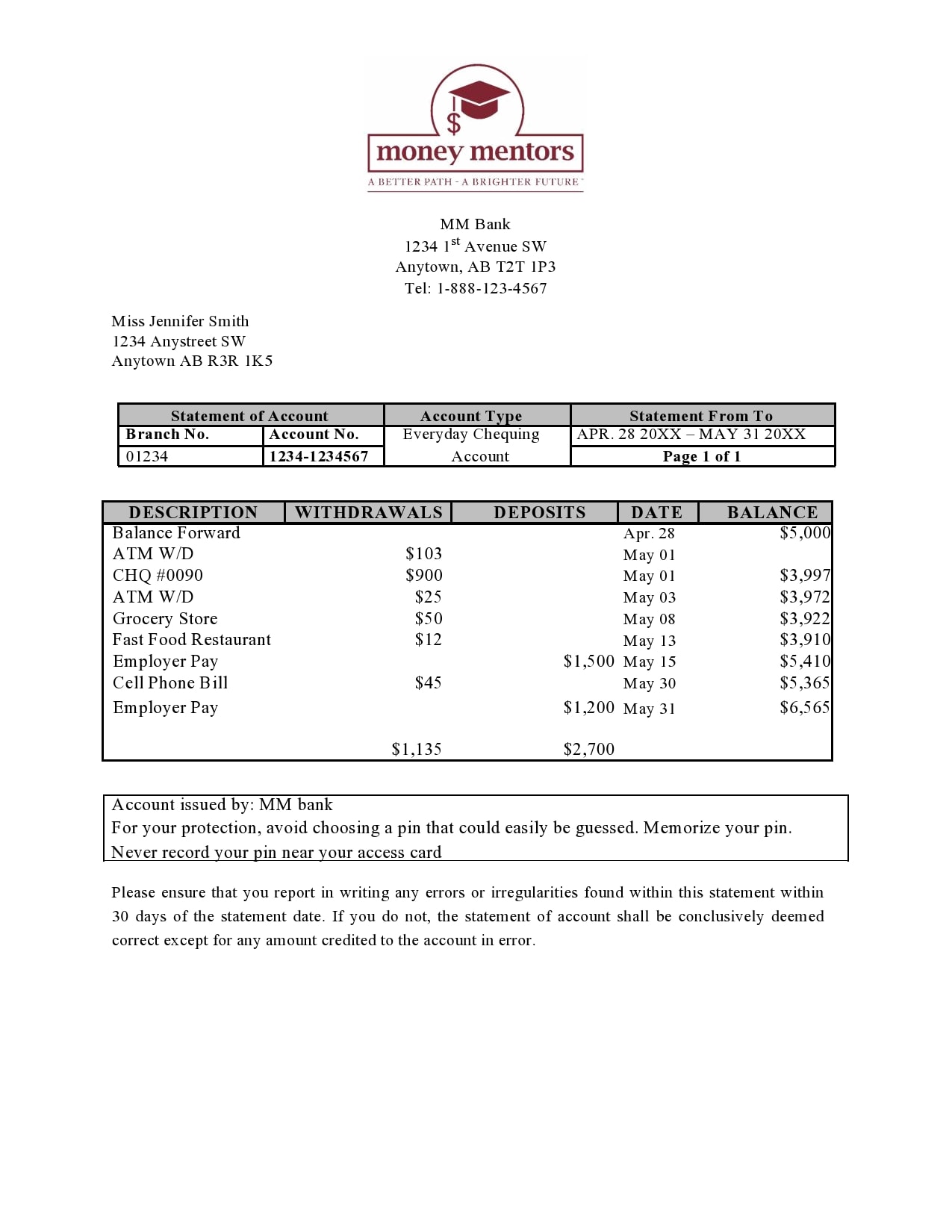

A good credit card statement template should provide a comprehensive overview of your credit card activity for a specific billing cycle. It acts as a financial report, summarizing your purchases, payments, and any associated fees or interest charges. Understanding the different sections of the template is crucial for effective financial management.

-

Account Summary:

This section offers a snapshot of your account’s status. Key information found here includes:

- Account Number: Your unique credit card identifier.

- Statement Date: The date the statement was generated.

- Credit Limit: The maximum amount you can charge to your card.

- Available Credit: The remaining credit you have available to spend.

- Previous Balance: The amount you owed from the previous billing cycle.

- Payments: The total amount of payments you made during the billing cycle.

- Purchases: The total amount of purchases you made during the billing cycle.

- Balance Transfers: Any amounts transferred to your card from other accounts.

- Cash Advances: Any cash withdrawals you made using your card.

- Fees: Any fees charged to your account, such as late payment fees or annual fees.

- Interest Charged: The amount of interest charged on your outstanding balance.

- New Balance: The total amount you owe at the end of the billing cycle.

- Minimum Payment Due: The minimum amount you must pay to avoid late payment fees.

- Payment Due Date: The date by which your payment must be received.

-

Transaction Details:

This is the most detailed section of your statement. It lists every transaction made during the billing cycle, including:

- Date: The date the transaction occurred.

- Description: A brief description of the transaction, typically including the merchant’s name.

- Amount: The amount of the transaction.

Reviewing this section carefully is crucial for identifying any unauthorized transactions or errors.

-

Interest Charge Calculation:

This section explains how interest charges are calculated. Key information found here includes:

- Annual Percentage Rate (APR): The interest rate charged on your outstanding balance, expressed as an annual percentage. Different APRs may apply to different types of transactions, such as purchases, cash advances, and balance transfers.

- Balance Subject to Interest Rate: The portion of your balance that is subject to interest charges.

- Daily Periodic Rate: The daily interest rate, calculated by dividing the APR by 365.

- How Interest is Calculated: A brief explanation of the method used to calculate interest charges (e.g., average daily balance method).

Understanding this section helps you understand how much interest you are paying and how to minimize interest charges.

-

Fees:

This section details any fees charged to your account during the billing cycle. Common fees include:

- Late Payment Fees: Charged when you fail to make the minimum payment by the due date.

- Annual Fees: Charged annually for the privilege of having the credit card.

- Over-the-Limit Fees: Charged if you exceed your credit limit.

- Cash Advance Fees: Charged for withdrawing cash using your credit card.

- Foreign Transaction Fees: Charged for making purchases in foreign currencies.

-

Important Information:

This section typically contains important information about your cardholder agreement, changes to terms and conditions, and contact information for customer service. It may also include information about fraud prevention and dispute resolution.

Using Your Credit Card Statement Template Effectively

Once you understand the different sections of your credit card statement, you can use it to your advantage in several ways:

- Track Your Spending: Monitor your purchases to identify areas where you can cut back on spending.

- Detect Fraudulent Activity: Regularly review your transaction details to identify any unauthorized charges. Report any suspicious activity to your credit card issuer immediately.

- Manage Your Debt: Pay your balance in full each month to avoid interest charges. If you can’t pay the full balance, make at least the minimum payment and try to pay more whenever possible.

- Understand Your Credit Score: Your credit card payment history is a major factor in determining your credit score. Making timely payments will help you maintain a good credit score.

- Identify and Dispute Errors: If you find any errors on your statement, such as incorrect charges or payments, contact your credit card issuer immediately to dispute the error. Document everything related to the dispute, including dates, conversations, and any supporting evidence.

By taking the time to understand and analyze your credit card statement template, you can gain valuable insights into your financial habits and make informed decisions about your spending and debt management. This proactive approach can help you achieve your financial goals and avoid potential pitfalls.

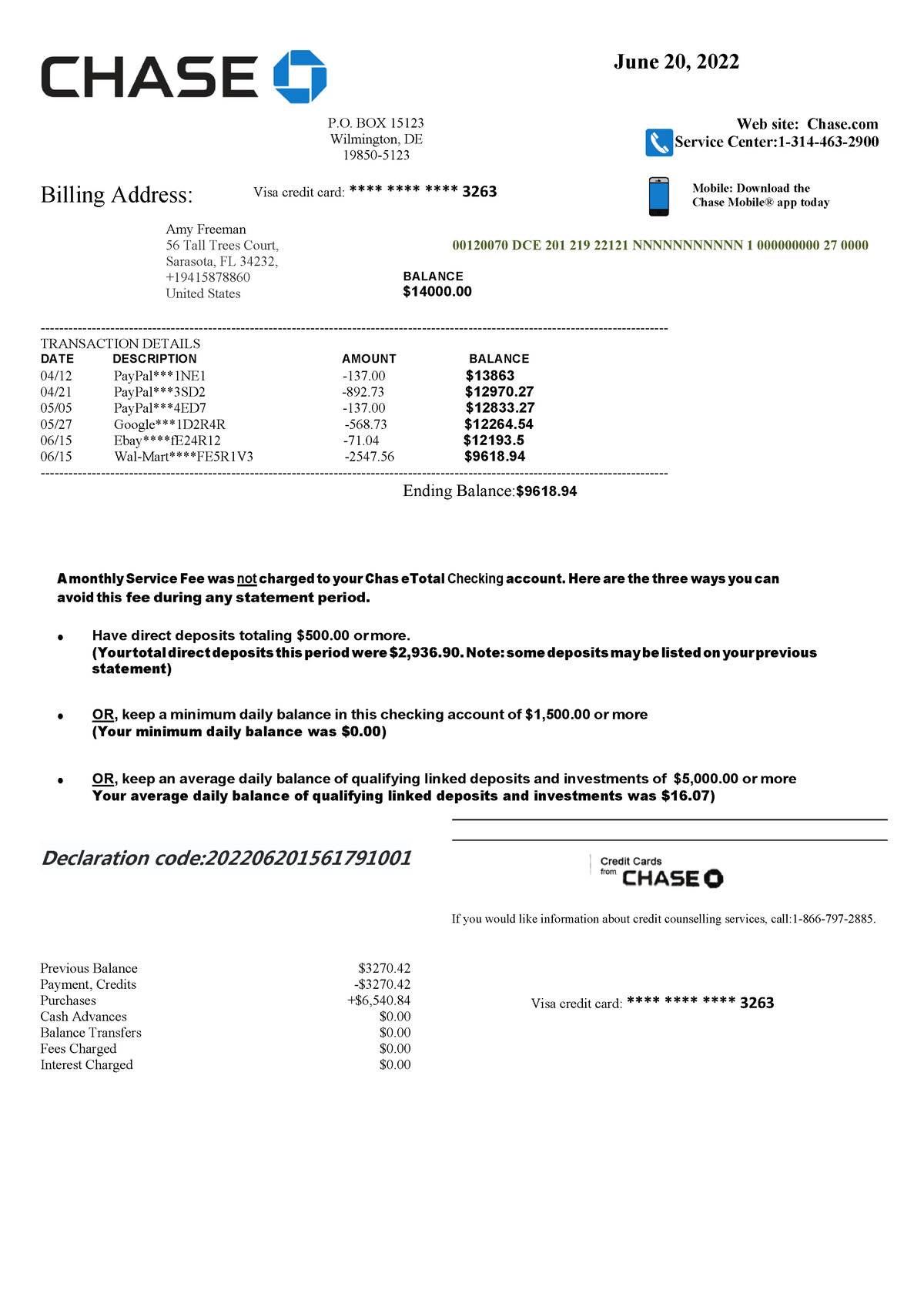

If you are searching about Chase Bank Check Template Lovely 7 Chase Bank Stateme – vrogue.co you’ve visit to the right place. We have 9 Pictures about Chase Bank Check Template Lovely 7 Chase Bank Stateme – vrogue.co like Doctempl – USA Wells Fargo bank credit card statement template in Word, Credit Card Statement Template in Excel, Google Sheets – Download and also Credit Card Statement Template – Sarseh.com. Read more:

Chase Bank Check Template Lovely 7 Chase Bank Stateme – Vrogue.co

www.vrogue.co

35 Editable Bank Statement Templates [FREE] ᐅ TemplateLab

![35 Editable Bank Statement Templates [FREE] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2021/03/Bank-of-America-Bank-Statement-TemplateLab.com_.jpg)

templatelab.com

Credit Card Statement Template – Sarseh.com

sarseh.com

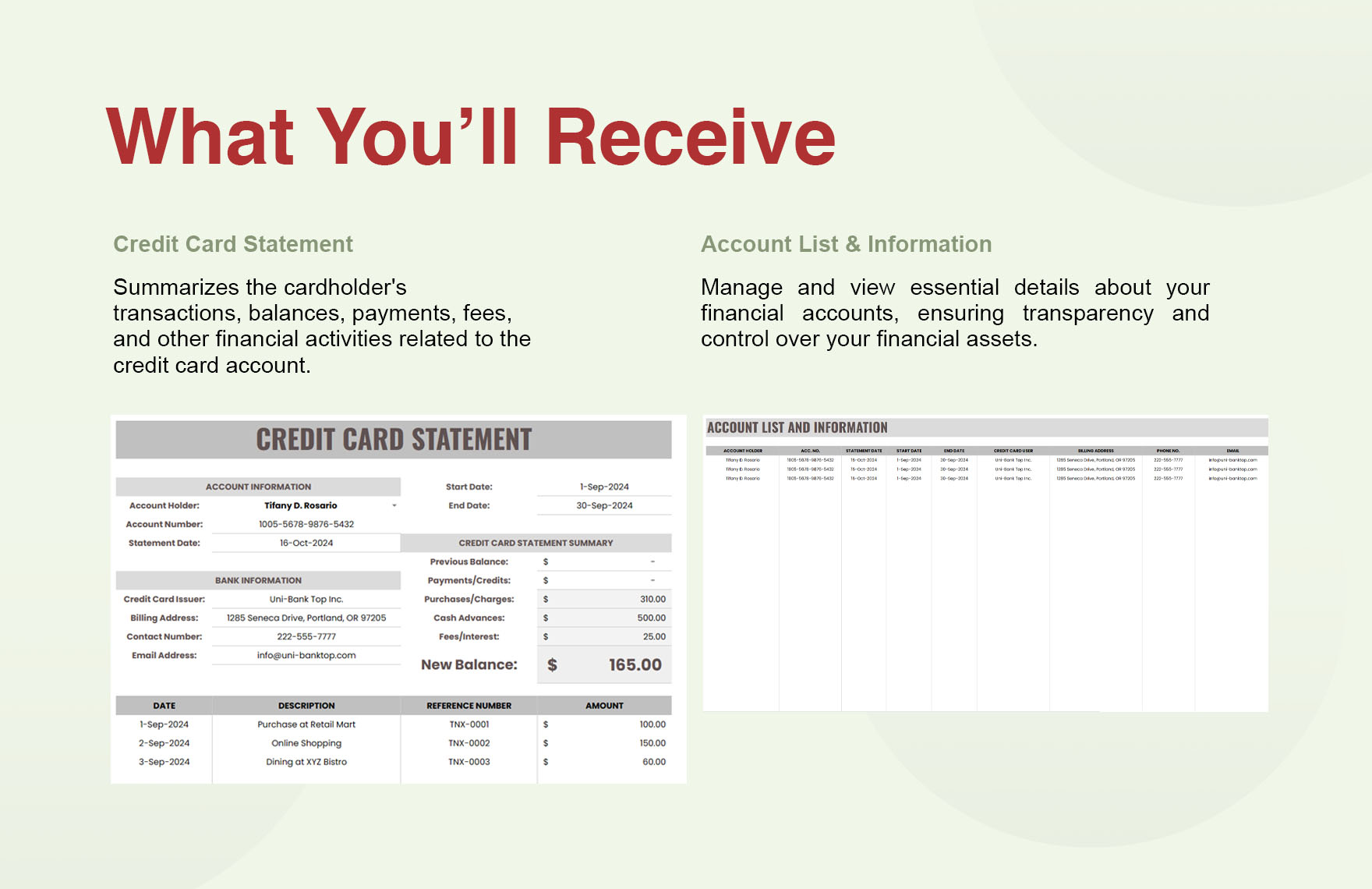

Credit Card Statement Template In Excel, Google Sheets – Download

www.template.net

Pin On Card Template

www.pinterest.com

Credit Card Statement Template In Excel, Google Sheets – Download

www.template.net

Credit Card Statement Template Word – Content Calendar Template

local.ultimatemotorcycling.com

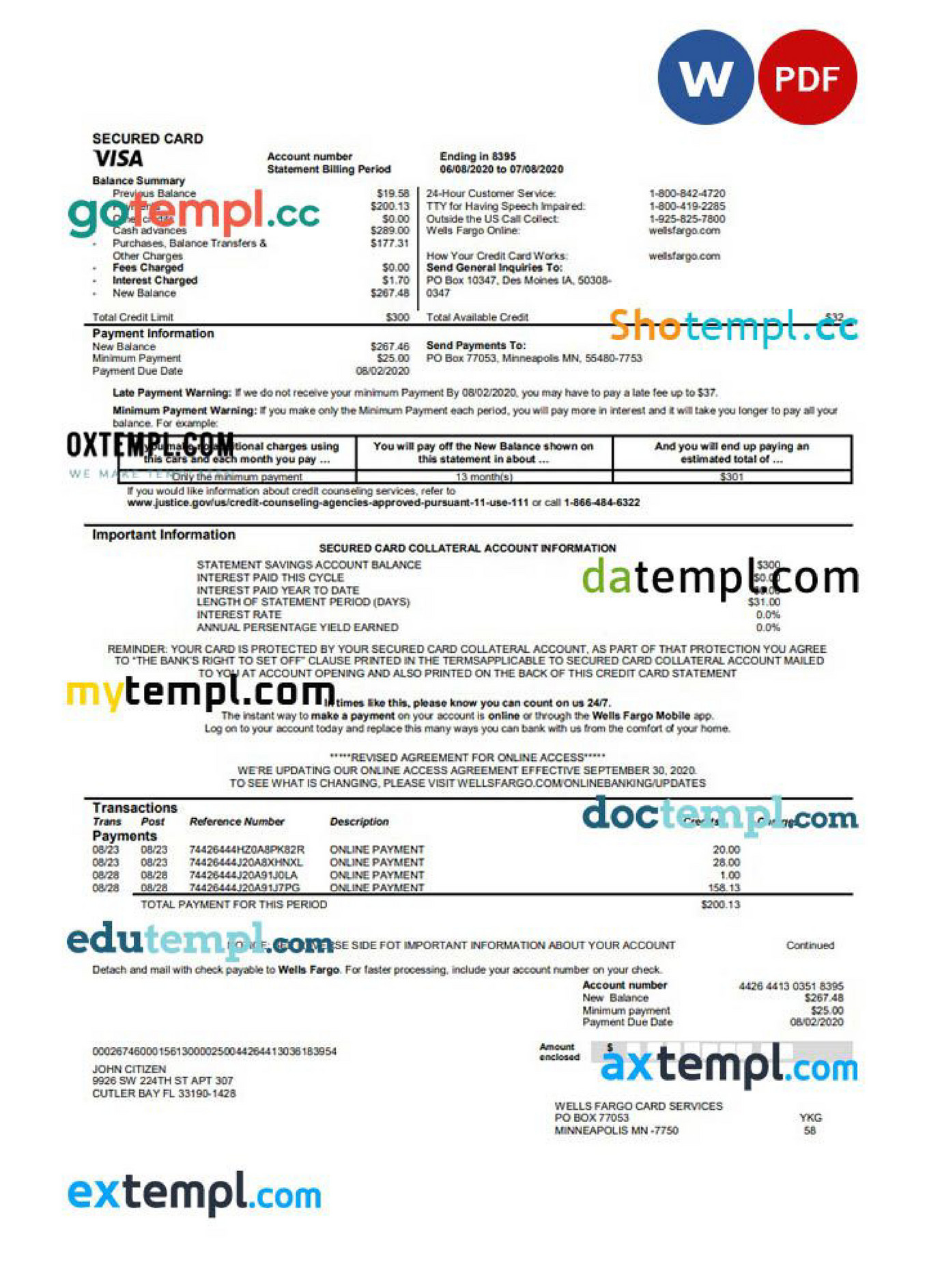

Doctempl – USA Wells Fargo Bank Credit Card Statement Template In Word

view.publitas.com

Credit Card Statement Template – KAESG BLOG

kaesg.com

35 editable bank statement templates [free] ᐅ templatelab. Credit card statement template – kaesg blog. Credit card statement template in excel, google sheets