Creating a comprehensive and accurate business valuation report is crucial for a variety of reasons, including mergers & acquisitions (M&A), securing financing, estate planning, and even internal ownership disputes. A well-structured report provides a clear and justifiable assessment of a company’s worth, supporting informed decision-making. However, drafting a valuation report from scratch can be a daunting task. This is where a Business Valuation Report Template Worksheet becomes an invaluable tool. It provides a structured framework, ensuring you cover all essential aspects and present your findings in a professional and easily digestible format. This post explores the benefits of using a template, the key components typically included, and how a well-designed worksheet can significantly streamline the valuation process.

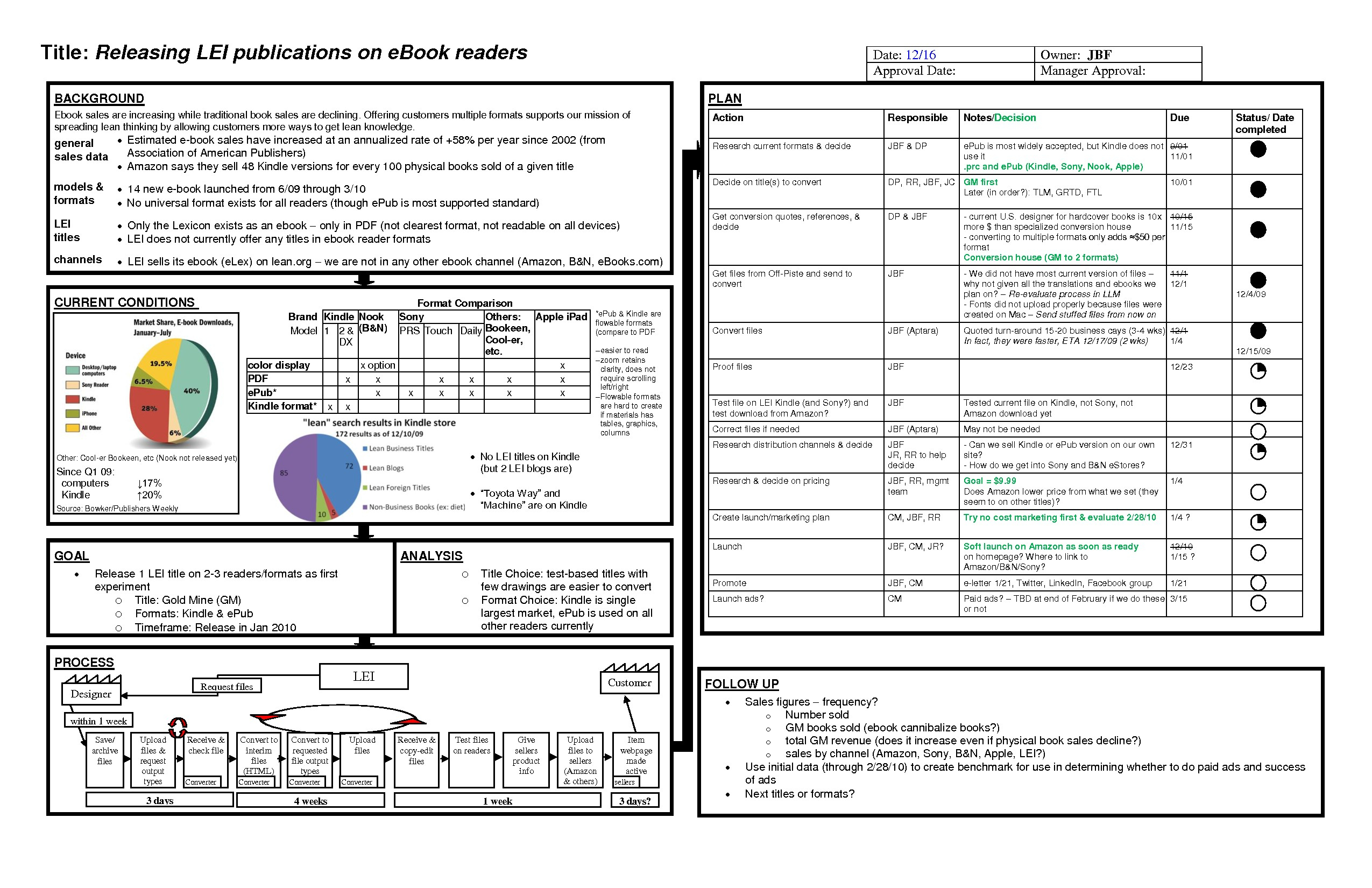

Instead of staring at a blank page, a pre-designed template guides you through the necessary steps. It prompts you to gather relevant data, perform required analyses, and present your conclusions in a logical sequence. This not only saves time but also reduces the risk of overlooking crucial information or making errors in your calculations. A good template also often includes embedded formulas and calculations, further automating the process and minimizing manual effort. Furthermore, consistency is key, especially when dealing with multiple valuations or presenting findings to different stakeholders. A template ensures a standardized approach, making it easier to compare different valuations and build confidence in the results.

Key Components of a Business Valuation Report Template Worksheet

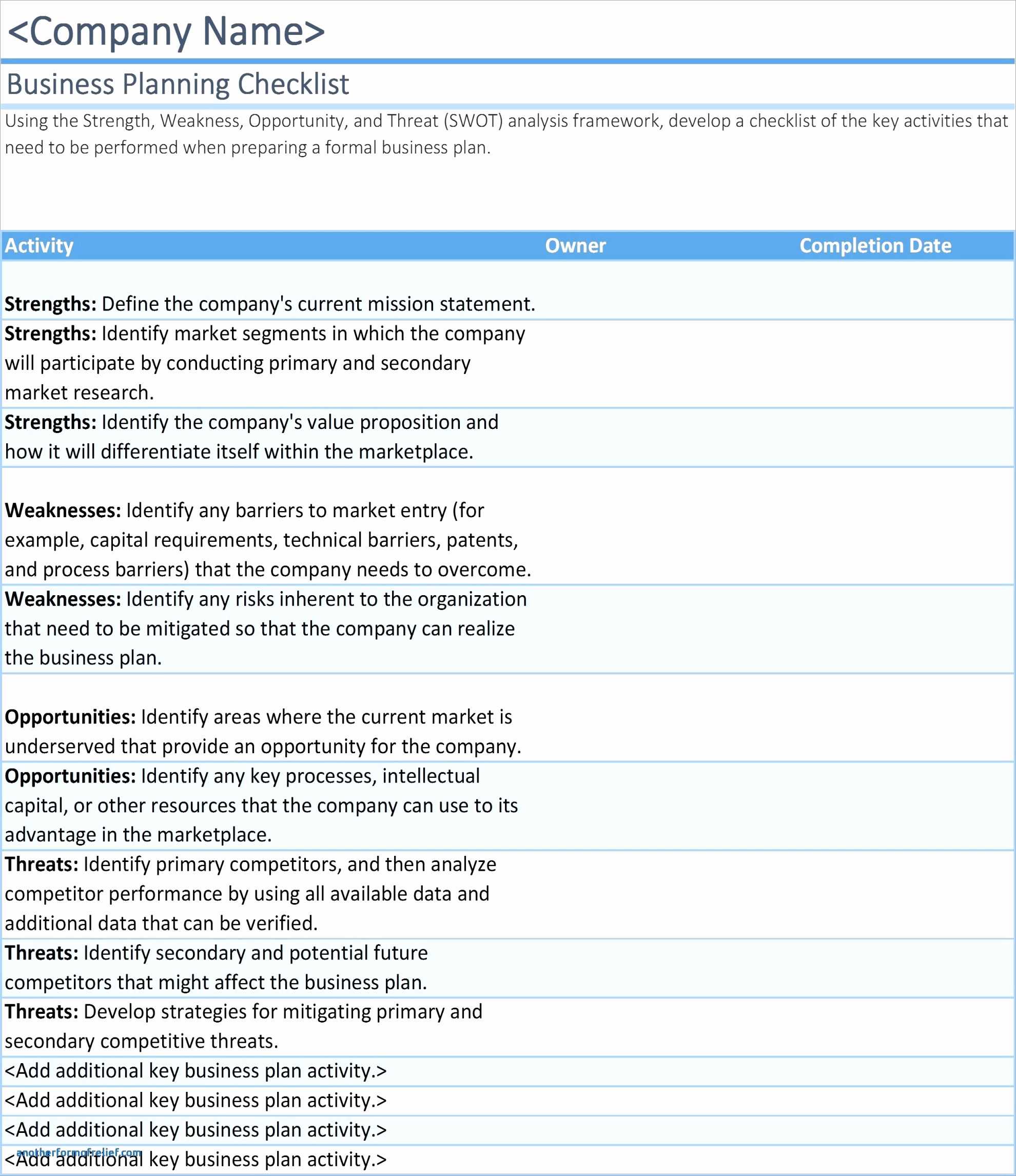

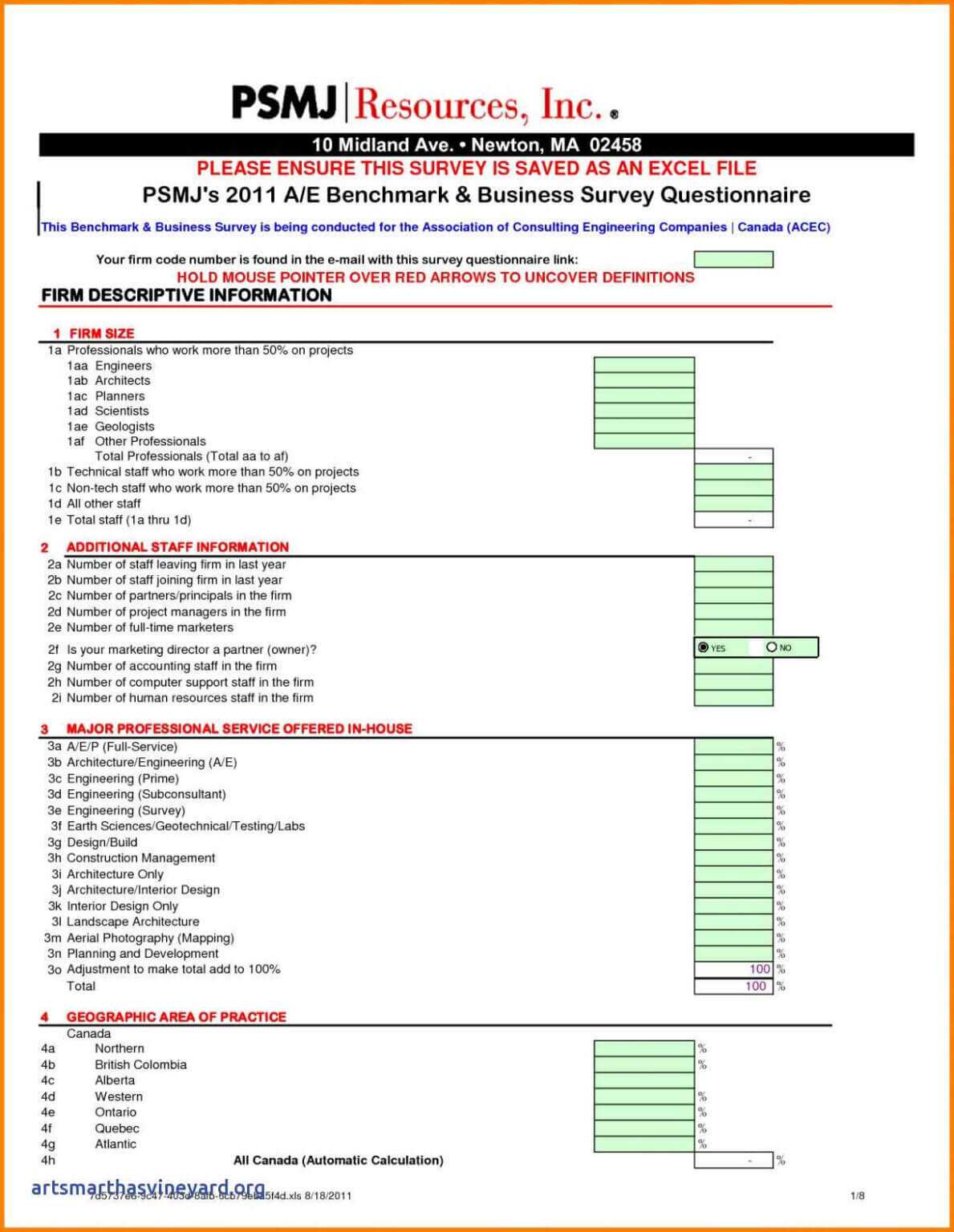

A comprehensive business valuation report template should cover a range of essential sections, each contributing to a holistic assessment of the company’s worth. Below is a breakdown of common elements you’ll typically find:

- Executive Summary: A concise overview of the valuation, including the purpose of the valuation, the date of the valuation, the valuation approaches used, and the final value conclusion. This is often the first section reviewed, so it needs to be clear and impactful.

- Company Overview: A detailed description of the company’s business, history, industry, products or services, target market, and competitive landscape. This section provides context for the valuation.

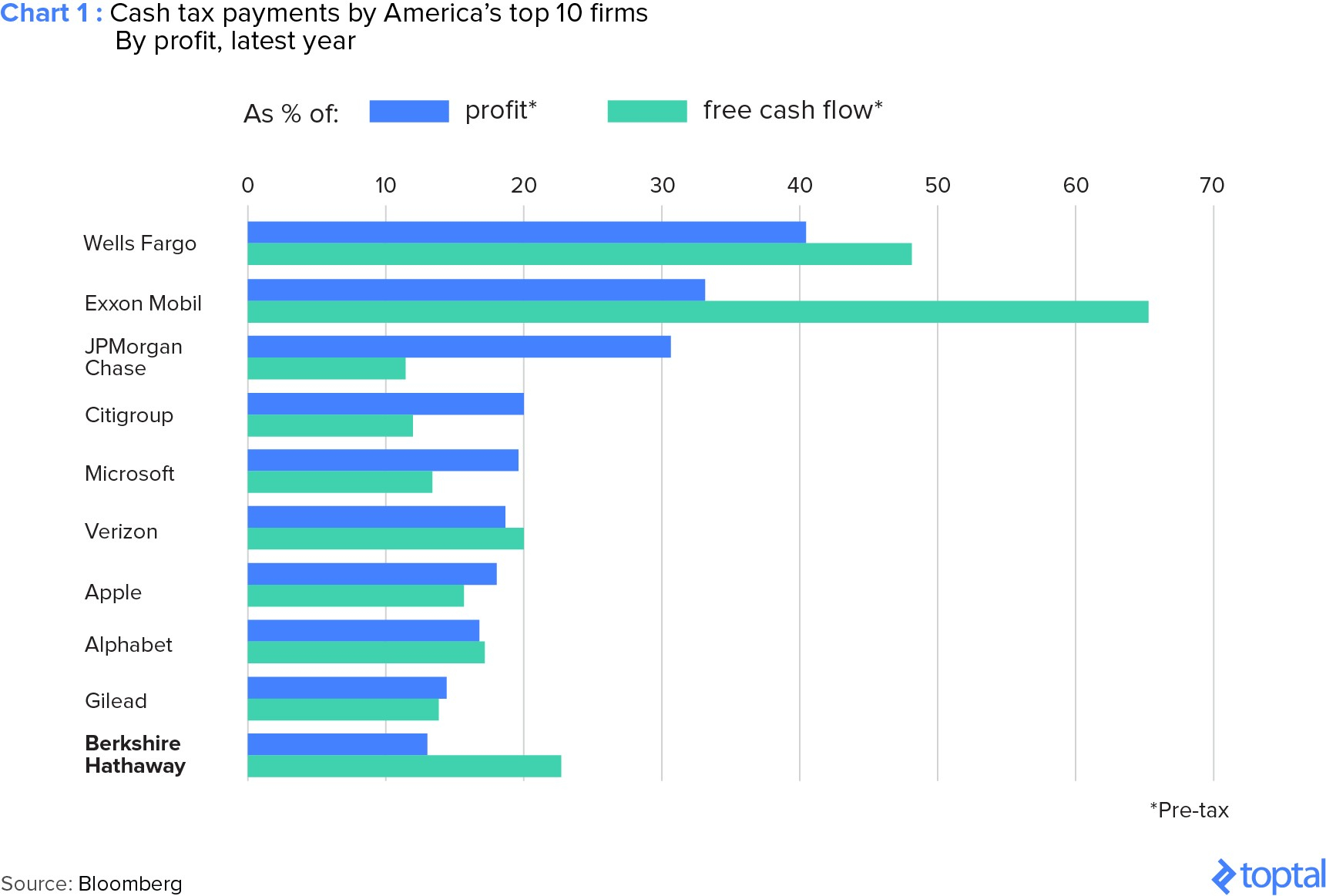

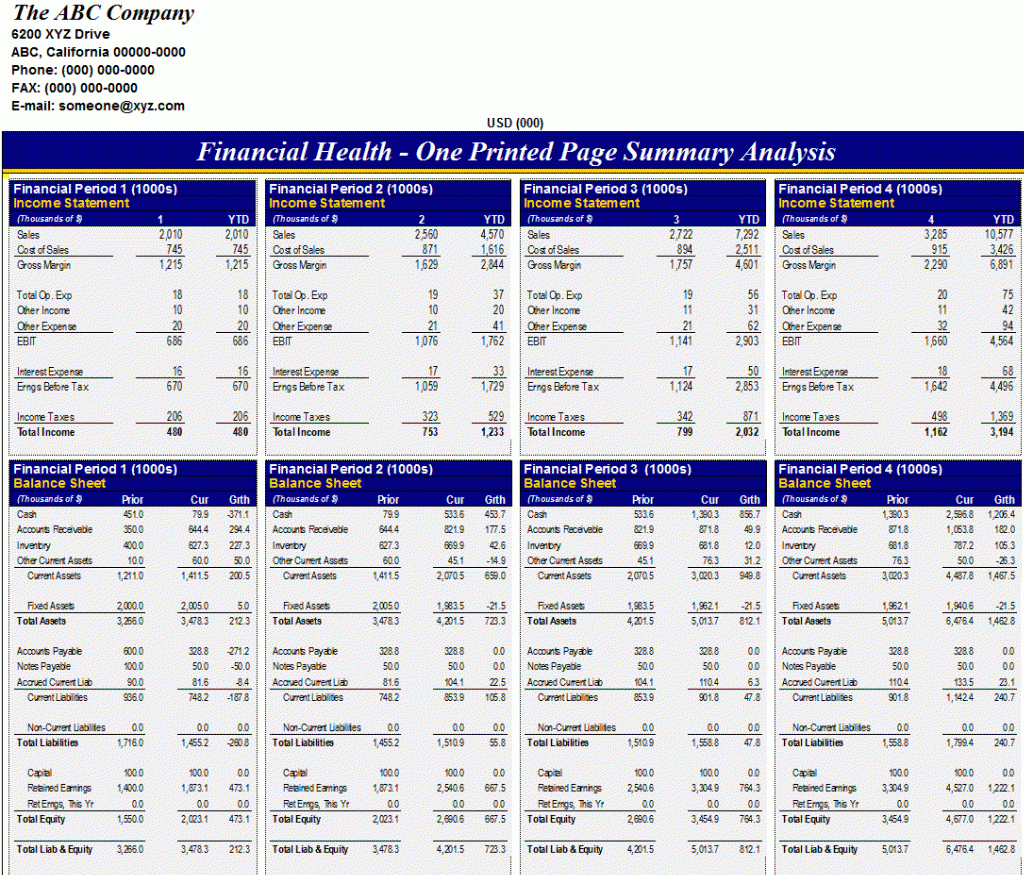

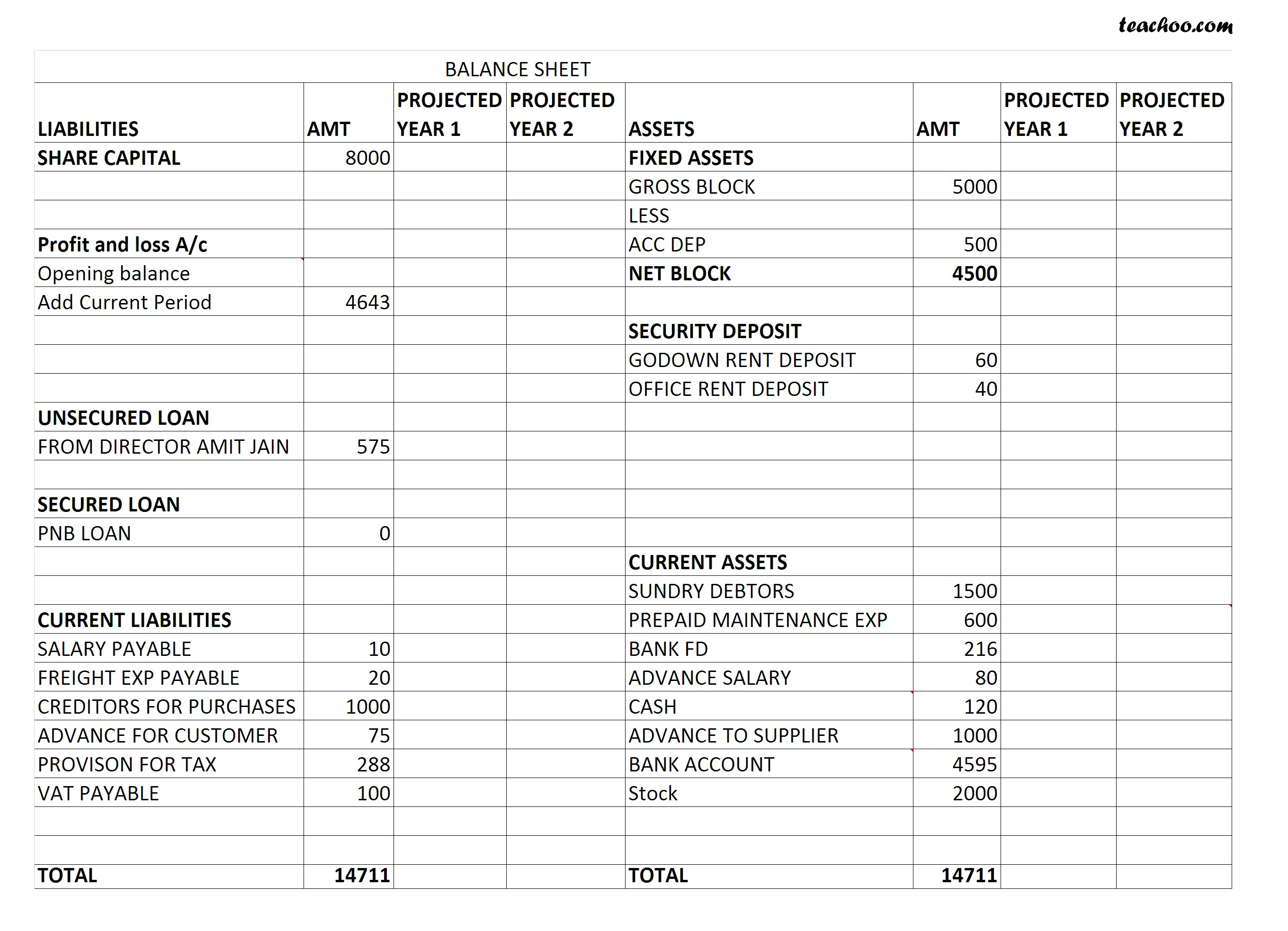

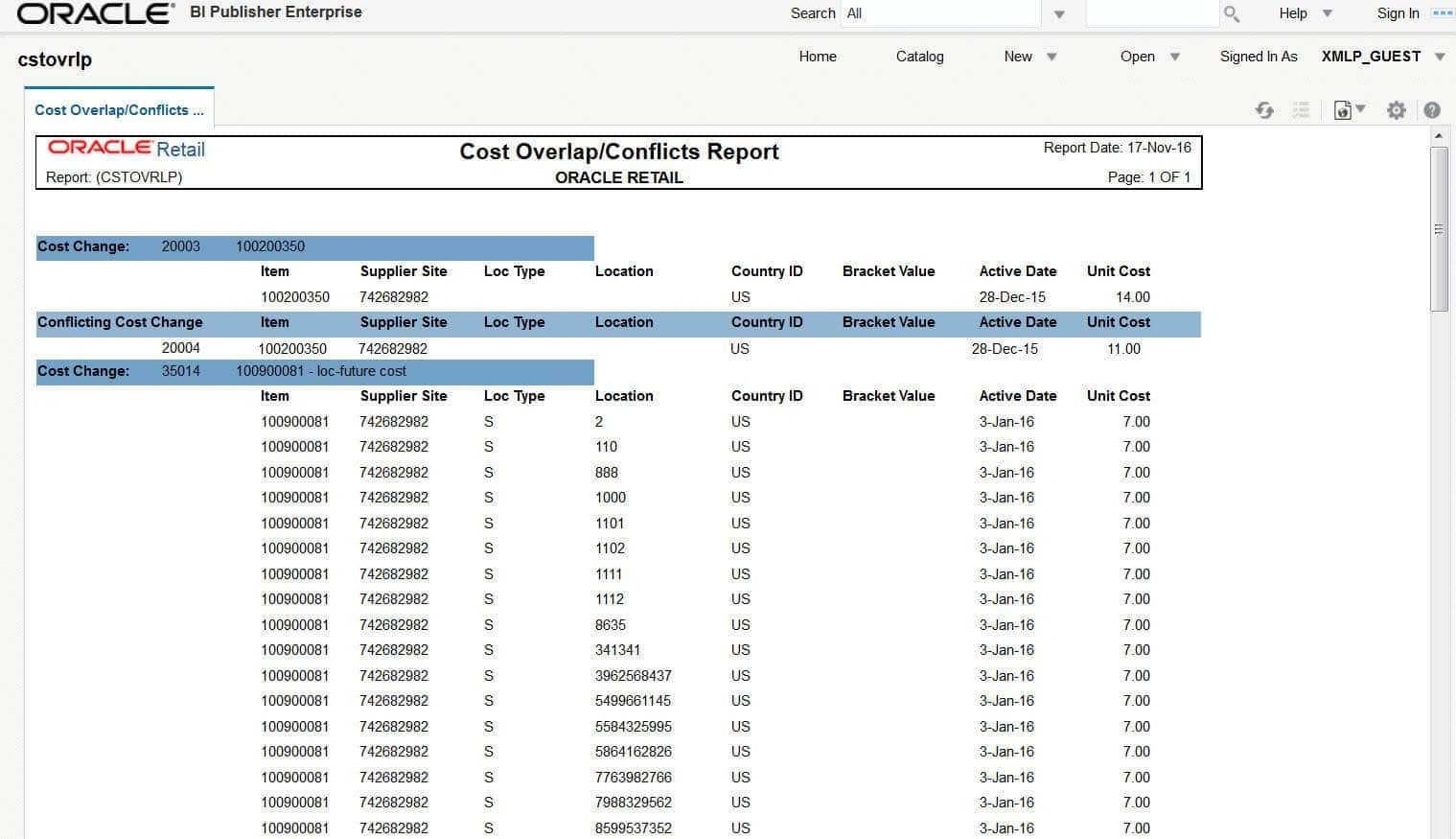

- Financial Analysis: A deep dive into the company’s financial performance, including historical financial statements (balance sheets, income statements, cash flow statements), trend analysis, ratio analysis, and benchmarking against industry peers. This section is the bedrock of many valuation methodologies.

- Industry Analysis: An examination of the industry in which the company operates, including market size, growth rates, trends, competition, and regulatory environment. This helps to understand the opportunities and threats facing the business.

- Economic Outlook: An assessment of the current and future economic conditions that may impact the company’s value, including factors such as interest rates, inflation, and economic growth.

- Valuation Approaches: Detailed explanations of the valuation methodologies used, such as the income approach (discounted cash flow, capitalization of earnings), the market approach (comparable company analysis, precedent transactions), and the asset approach (net asset value). The selection of appropriate methodologies is crucial for a defensible valuation.

- Valuation Calculations: The actual calculations performed to arrive at the valuation conclusion. This section should include clear explanations of the assumptions used and the rationale behind them.

- Assumptions and Limiting Conditions: A clear statement of the assumptions made during the valuation process and any limitations that may affect the accuracy of the results. Transparency is essential for maintaining credibility.

- Reconciliation of Values: If multiple valuation approaches are used, this section reconciles the values obtained from each approach and explains the rationale for weighting them to arrive at the final value conclusion.

- Conclusion: A clear and concise statement of the final value conclusion and any factors that may affect the value.

- Appendix: Supporting documents such as financial statements, industry reports, and management interviews.

How a Worksheet Streamlines the Valuation Process

A Business Valuation Report Template Worksheet can significantly streamline the valuation process in several ways:

Data Organization and Collection

- Structured Input Fields: Templates provide pre-defined fields for entering financial data, industry information, and other relevant inputs, ensuring that all necessary information is collected in a consistent and organized manner.

- Checklists and Prompts: Worksheets often include checklists and prompts to guide the user through the data collection process, reducing the risk of overlooking important information.

Analysis and Calculation

- Automated Calculations: Many templates include embedded formulas and calculations for common valuation metrics, such as discounted cash flow (DCF) analysis, capitalization rates, and market multiples. This automation reduces manual effort and the potential for errors.

- Scenario Analysis: Worksheets can facilitate scenario analysis by allowing the user to easily change key assumptions and see the impact on the valuation conclusion.

Reporting and Presentation

- Standardized Format: Templates ensure that the valuation report is presented in a consistent and professional format, making it easier for stakeholders to understand and interpret the results.

- Customization Options: Many templates offer customization options, allowing the user to tailor the report to the specific needs of the valuation and the audience.

In conclusion, a Business Valuation Report Template Worksheet is an indispensable tool for anyone involved in the valuation process. By providing a structured framework, automating calculations, and ensuring a standardized format, it saves time, reduces errors, and improves the overall quality of the valuation report. Whether you are a seasoned valuation professional or a business owner seeking to understand the value of your company, leveraging a well-designed template can significantly enhance your valuation efforts.

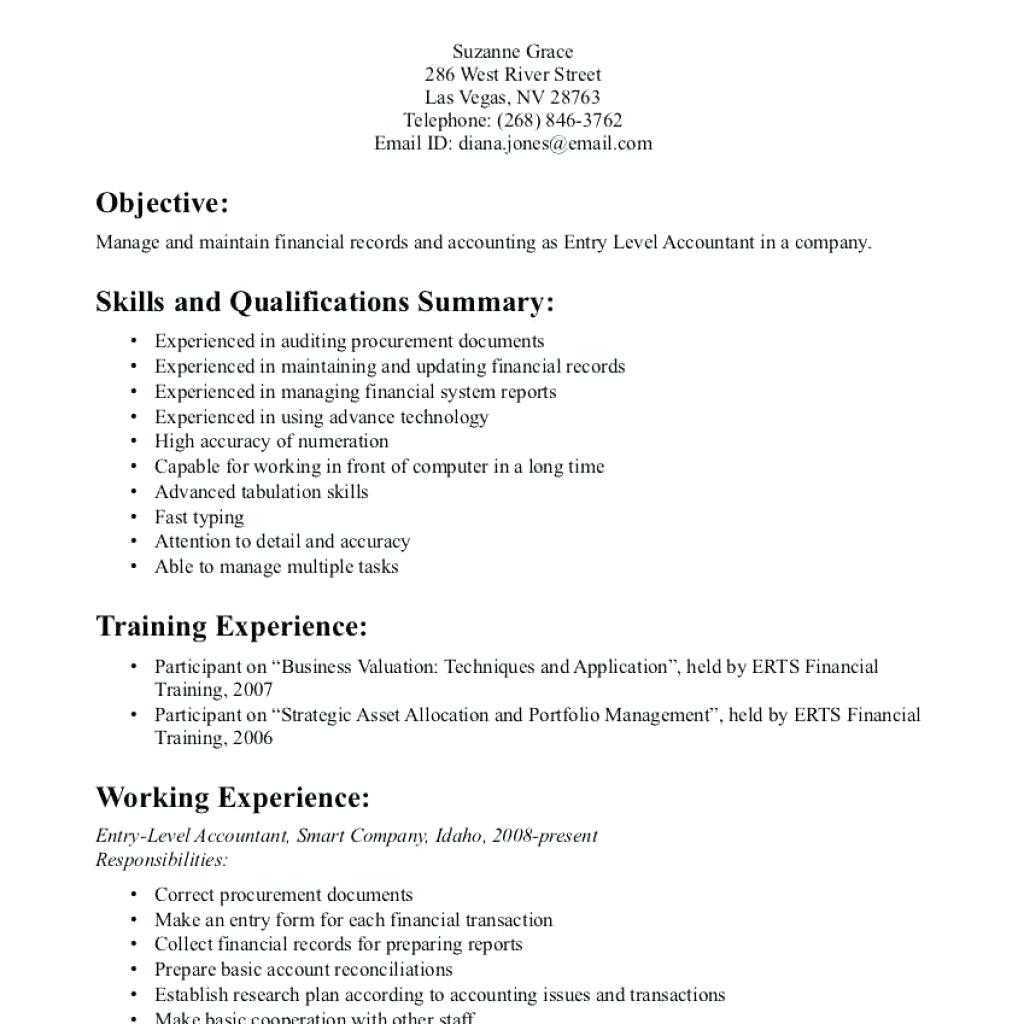

If you are searching about Business Valuation Report Template Worksheet Valid Should We regarding you’ve came to the right web. We have 9 Pics about Business Valuation Report Template Worksheet Valid Should We regarding like Business Valuation Spreadsheet Of Template Excel Report throughout, Business Valuation Spreadsheet Template Microsoft Model throughout and also Business Valuation Report Template Worksheet Valid How To Make. Read more:

Business Valuation Report Template Worksheet Valid Should We Regarding

vancecountyfair.com

Business Valuation Report Template Worksheet New Project Throughout

vancecountyfair.com

Business Valuation Spreadsheet Template Microsoft Model Throughout

pray.gelorailmu.com

valuation business spreadsheet microsoft gelorailmu pray

Business Valuation Spreadsheet Or Fantastic Report Template Within

business.fromgrandma.best

Business Valuation Report Template Worksheet Valid How To Make

vancecountyfair.com

Business Valuation Report Template Worksheet And Business And

db-excel.com

valuation throughout

Business Valuation Spreadsheet Of Template Excel Report Throughout

pray.gelorailmu.com

valuation business spreadsheet

Small Business Valuation Excel Template In Business Valuation Report

www.nwavwa.com

Business Valuation Report Template Fresh Worksheet Templates With

www.xfanzexpo.com

valuation fresh regard

Valuation business spreadsheet microsoft gelorailmu pray. Valuation fresh regard. Business valuation report template worksheet and business and