Managing your business finances effectively requires meticulous tracking of every transaction. One of the most crucial, yet often overlooked, aspects of financial management is bank reconciliation. This process ensures the accuracy of your financial records by comparing your internal accounting records with your bank statement. Discrepancies can arise due to various reasons like outstanding checks, deposits in transit, bank fees, or even errors in recording transactions. Therefore, a well-structured Business Bank Reconciliation Template becomes an indispensable tool for any business, regardless of its size. It provides a systematic approach to identify and rectify these discrepancies, ultimately painting a clearer and more accurate picture of your financial health.

Without regular bank reconciliation, you risk making ill-informed decisions based on inaccurate financial data. This can lead to overspending, missed payments, and even potential fraud. A Business Bank Reconciliation Template streamlines the process, making it easier to identify errors and maintain accurate financial records. Think of it as a critical bridge connecting your perception of your finances (as reflected in your books) with the bank’s official record. By systematically comparing these two sets of data, you can uncover discrepancies and take corrective action.

The benefits of using a bank reconciliation template extend beyond just finding errors. It helps you detect unauthorized transactions, track outstanding payments, and improve your overall financial control. By consistently performing bank reconciliations, you gain a deeper understanding of your cash flow and can make more informed decisions about your business’s financial future.

Business Bank Reconciliation Template Explained

A Business Bank Reconciliation Template is essentially a structured document, typically a spreadsheet, that helps you compare your company’s cash balance in your accounting records to the corresponding information on your bank statement. The goal is to identify any differences and explain why they exist. These differences often arise from timing issues, such as checks that haven’t cleared or deposits that haven’t been processed by the bank yet.

The template typically includes several key sections, which we’ll explore in more detail below. By filling out each section accurately, you’ll be able to systematically reconcile your bank statement with your internal records and ensure the accuracy of your financial statements.

Key Elements of a Business Bank Reconciliation Template

Here’s a breakdown of the common components you’ll find in a typical Business Bank Reconciliation Template:

- Beginning Balance per Bank Statement: This is the starting cash balance as reported on your bank statement for the period being reconciled. It’s crucial to use the exact figure provided by the bank.

- Add: Deposits in Transit: These are deposits that your company has recorded but haven’t yet been processed by the bank and therefore don’t appear on the bank statement. This could include deposits made late in the day or deposits sent electronically that are still processing.

- Deduct: Outstanding Checks: These are checks that your company has issued but haven’t yet been cashed or processed by the bank. These are written down as expenses in your books, but haven’t yet been reflected in the bank statement.

- Add/Deduct: Bank Errors: Occasionally, banks make errors. This section is used to correct any errors made by the bank, such as incorrect deposit amounts or fees charged in error. Contact the bank immediately to rectify the errors.

- Adjusted Bank Balance: This is the ending cash balance after adjusting for deposits in transit, outstanding checks, and bank errors. The formula is: Beginning Balance per Bank Statement + Deposits in Transit – Outstanding Checks +/- Bank Errors.

- Beginning Balance per Company Records: This is the starting cash balance according to your internal accounting records (e.g., your general ledger).

- Add: Collections/Credits Not on Books: These are items that have been credited to your bank account but not yet recorded in your company’s books. This may include interest earned on the account, direct deposits from customers, or electronic funds transfers (EFTs) received.

- Deduct: Unrecorded Charges/Debits: These are items that have been debited from your bank account but not yet recorded in your company’s books. This may include bank fees, NSF (non-sufficient funds) checks, or automatic payments.

- Add/Deduct: Book Errors: This section is used to correct any errors made in your company’s accounting records, such as incorrect recording of expenses or revenues.

- Adjusted Book Balance: This is the ending cash balance after adjusting for collections/credits not on books, unrecorded charges/debits, and book errors. The formula is: Beginning Balance per Company Records + Collections/Credits Not on Books – Unrecorded Charges/Debits +/- Book Errors.

- Final Reconciliation: Ideally, the Adjusted Bank Balance and the Adjusted Book Balance should be equal. If they are, your bank reconciliation is complete and successful. If they are not, you need to investigate the discrepancies further until you find and correct the errors.

Using a Business Bank Reconciliation Template regularly (typically monthly) helps you maintain accurate financial records, prevent fraud, and make informed business decisions. There are many readily available templates online, in various formats such as Microsoft Excel or Google Sheets. Choose one that best suits your business needs and ensure it aligns with your accounting software.

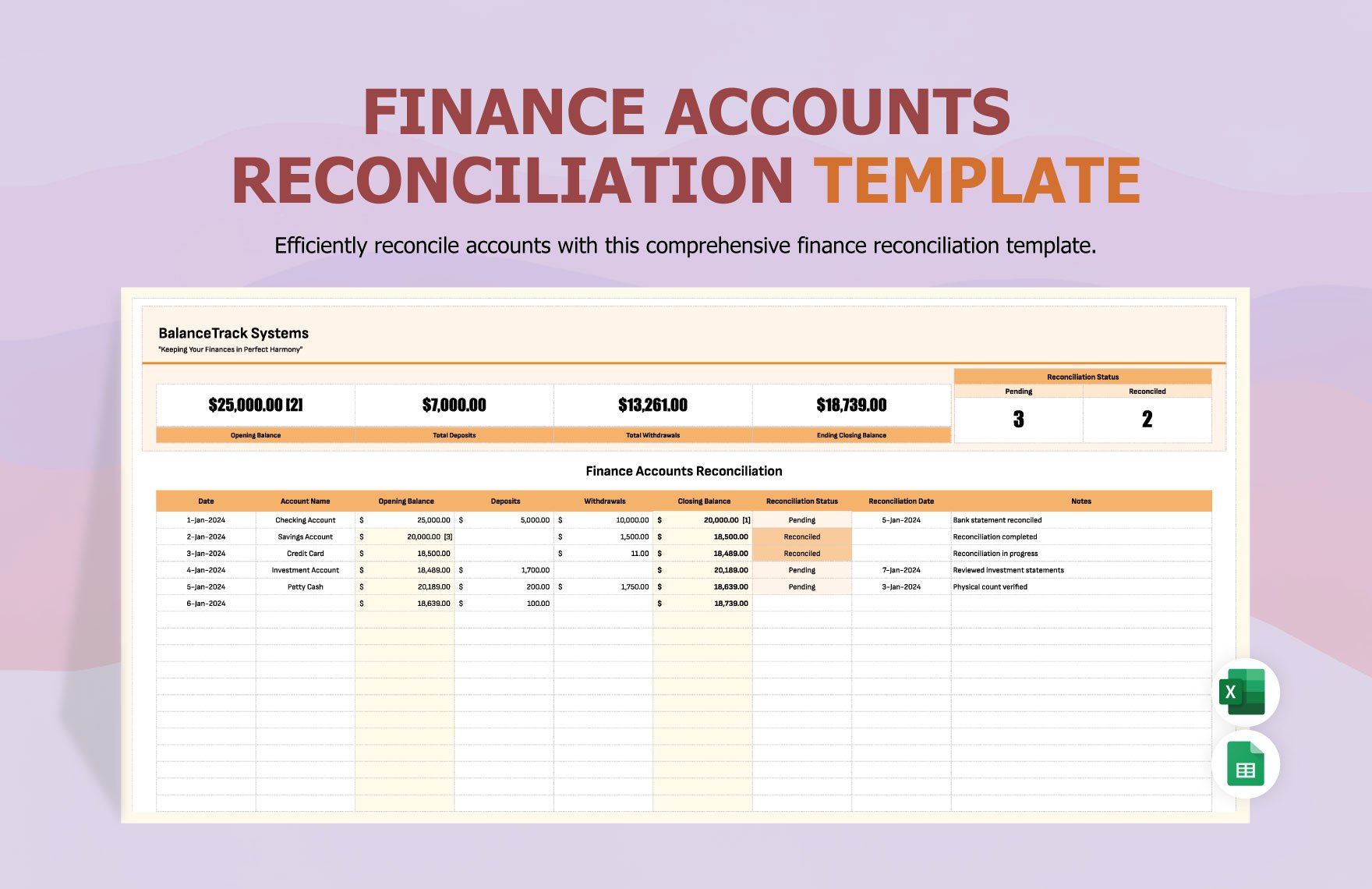

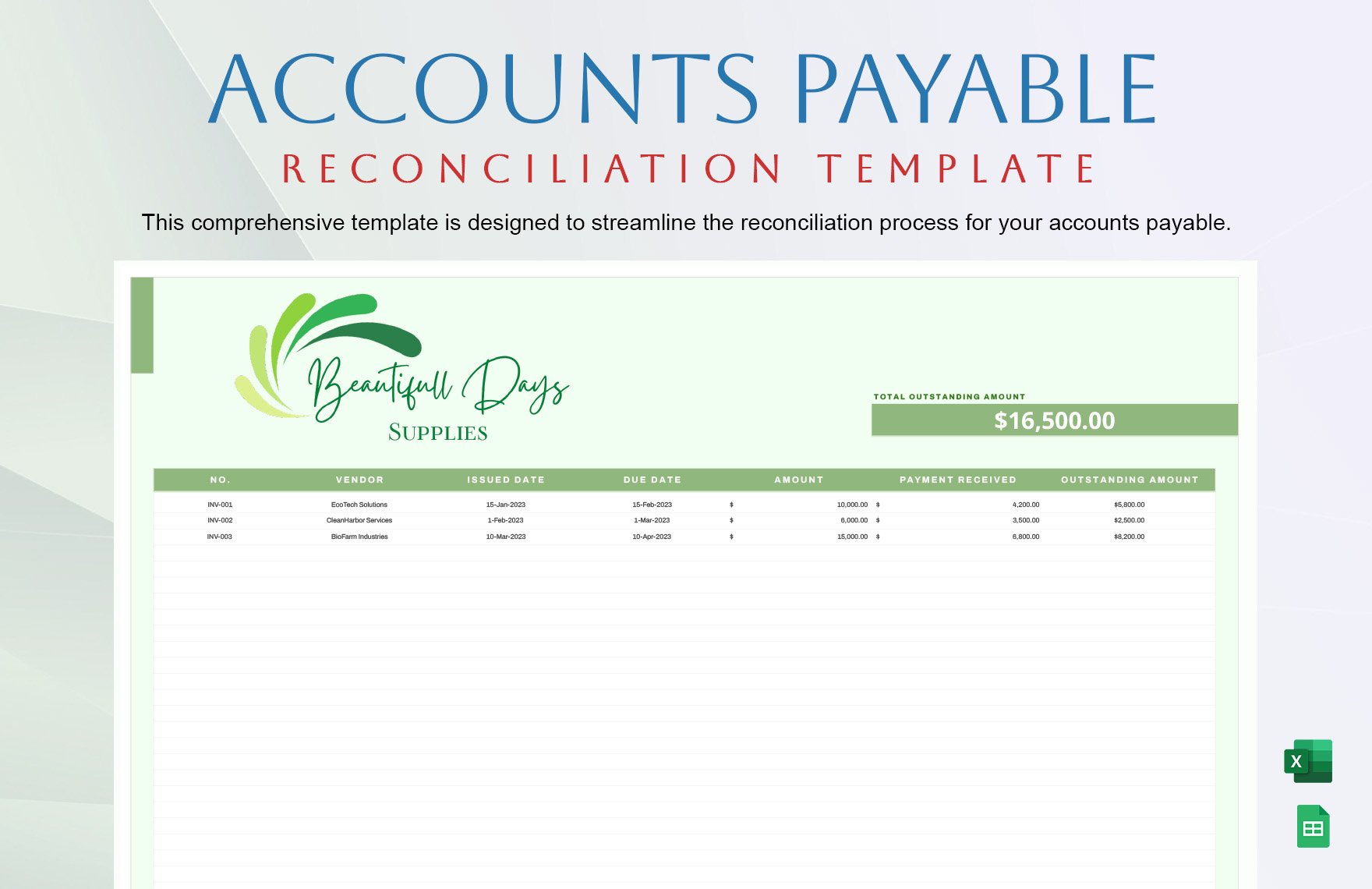

If you are looking for Editable Reconciliation Templates in Excel to Download you’ve visit to the right page. We have 9 Images about Editable Reconciliation Templates in Excel to Download like Business Bank Reconciliation Template in Google Sheets, Excel, Business Bank Reconciliation Template in Google Sheets, Excel and also Editable Reconciliation Templates in Excel to Download. Read more:

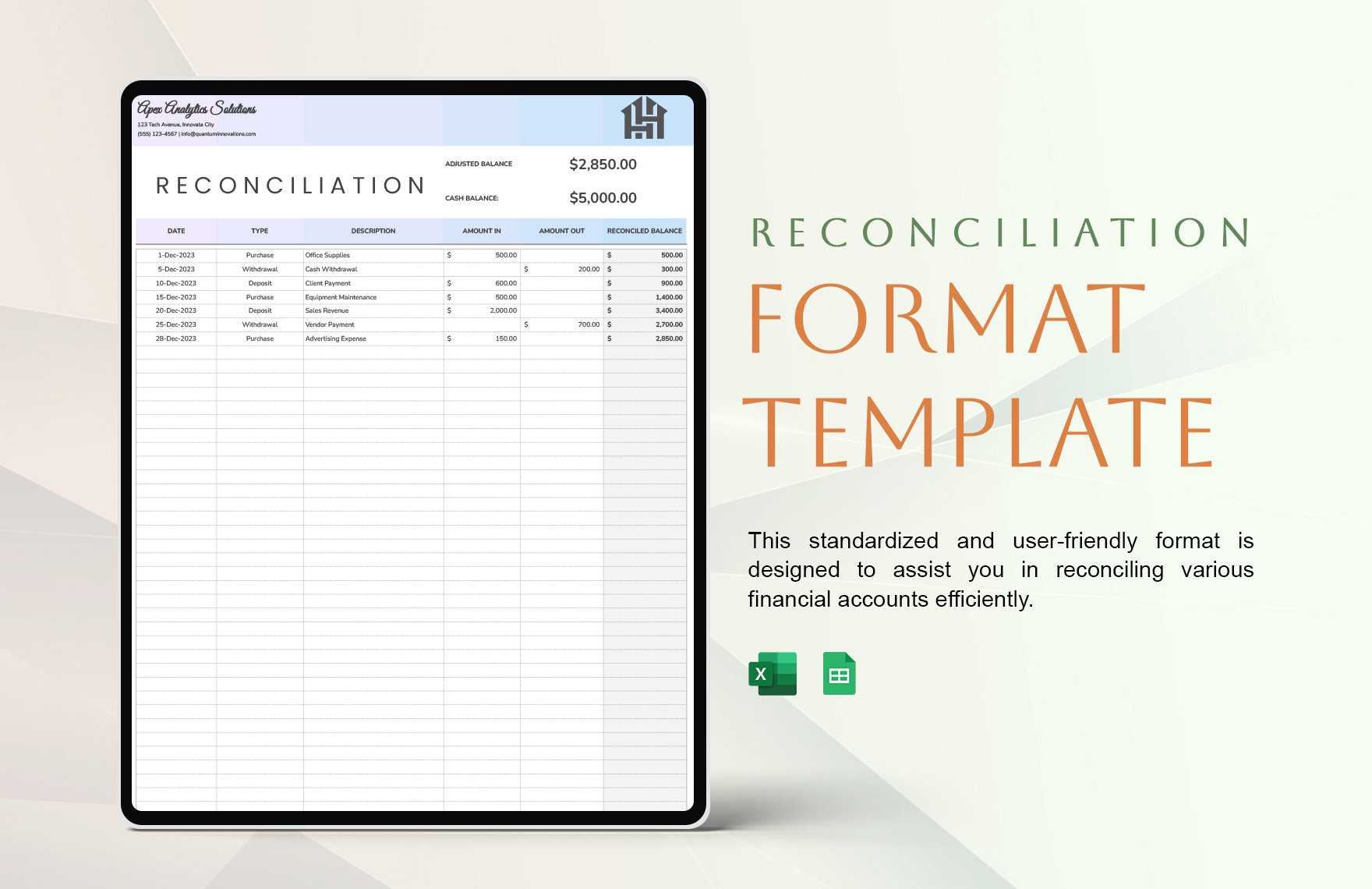

Editable Reconciliation Templates In Excel To Download

www.template.net

Editable Reconciliation Templates In Excel To Download

www.template.net

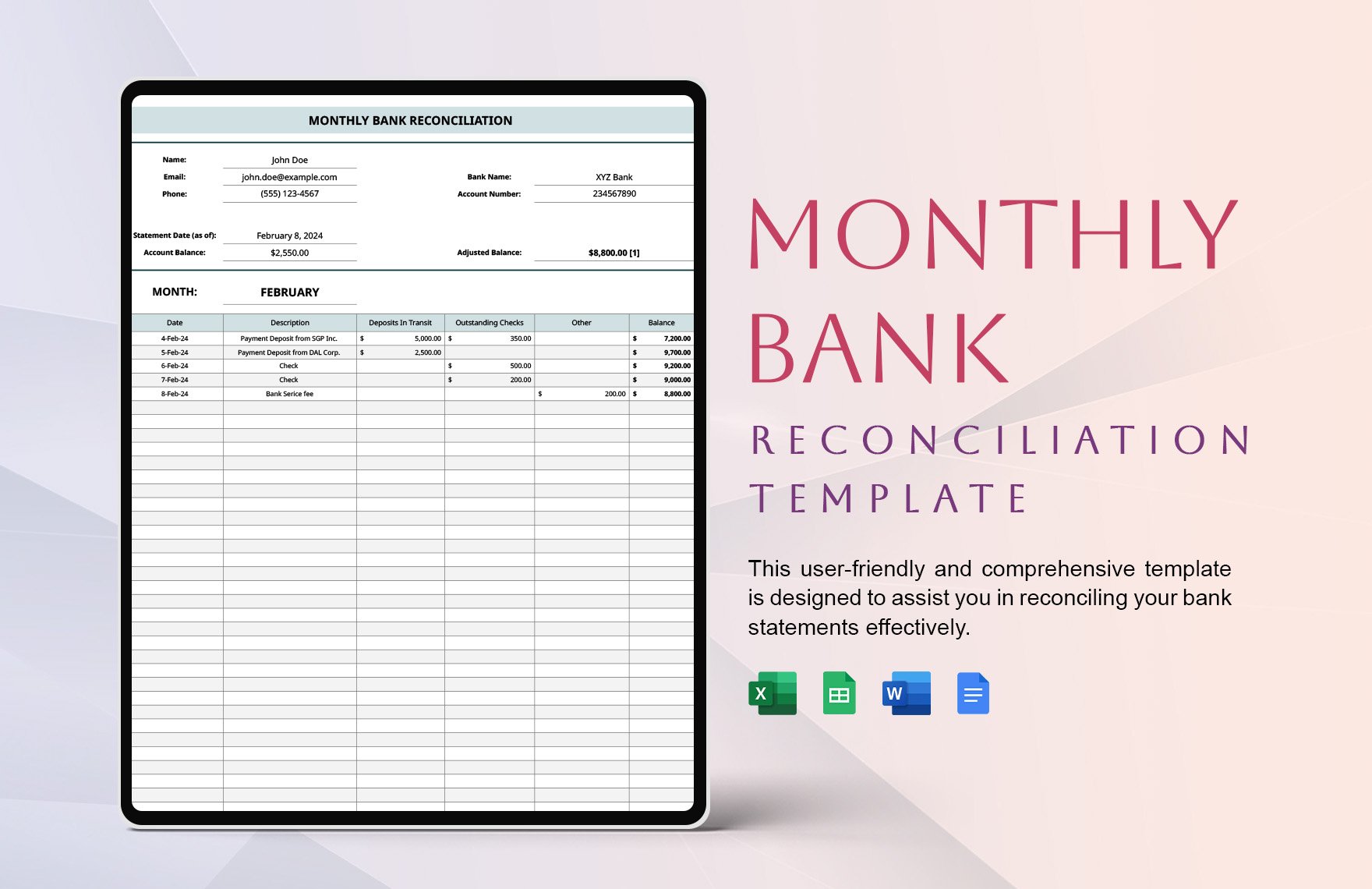

Editable Reconciliation Templates In Excel To Download

www.template.net

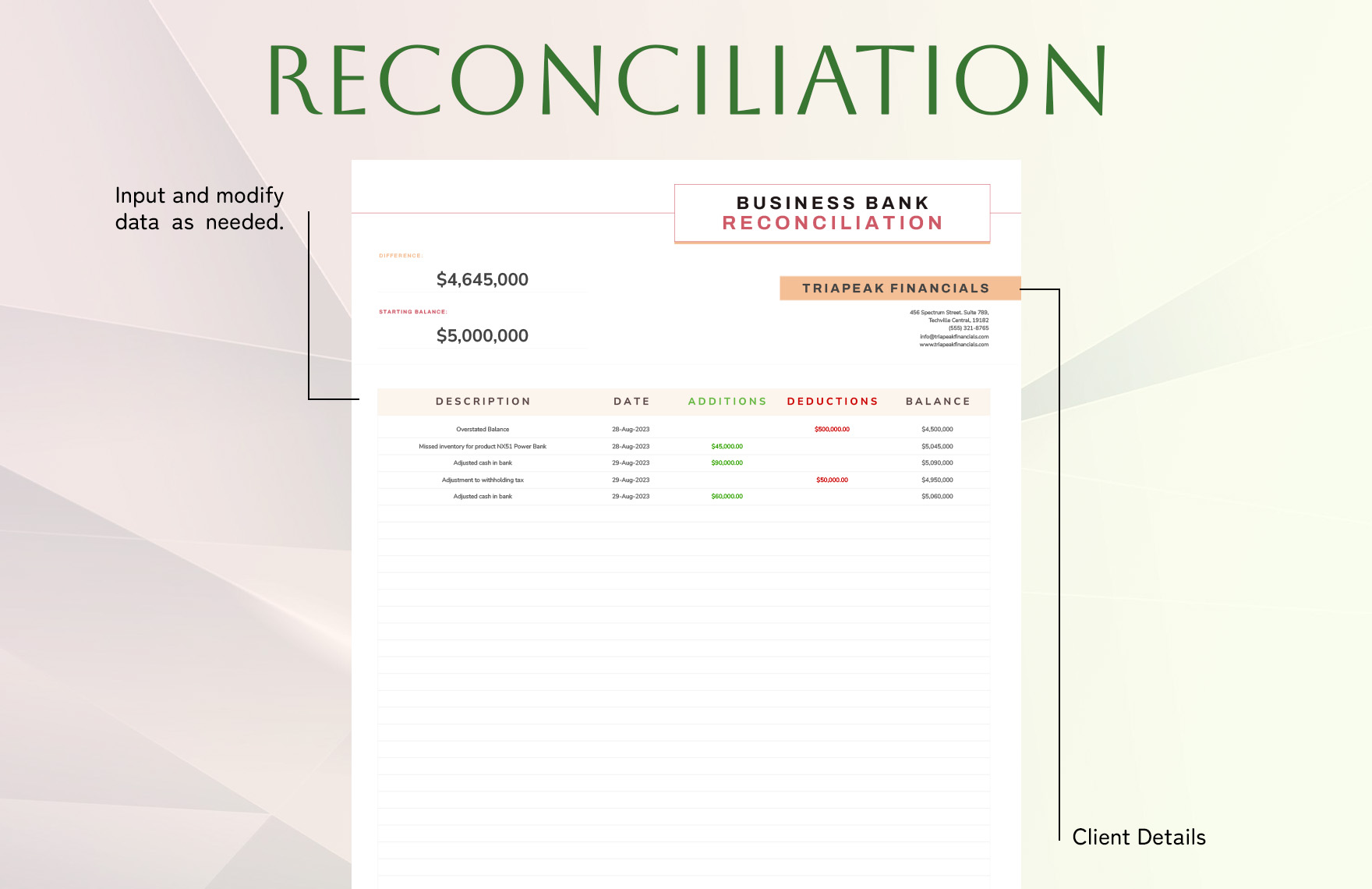

Business Bank Reconciliation Template In Google Sheets, Excel

www.template.net

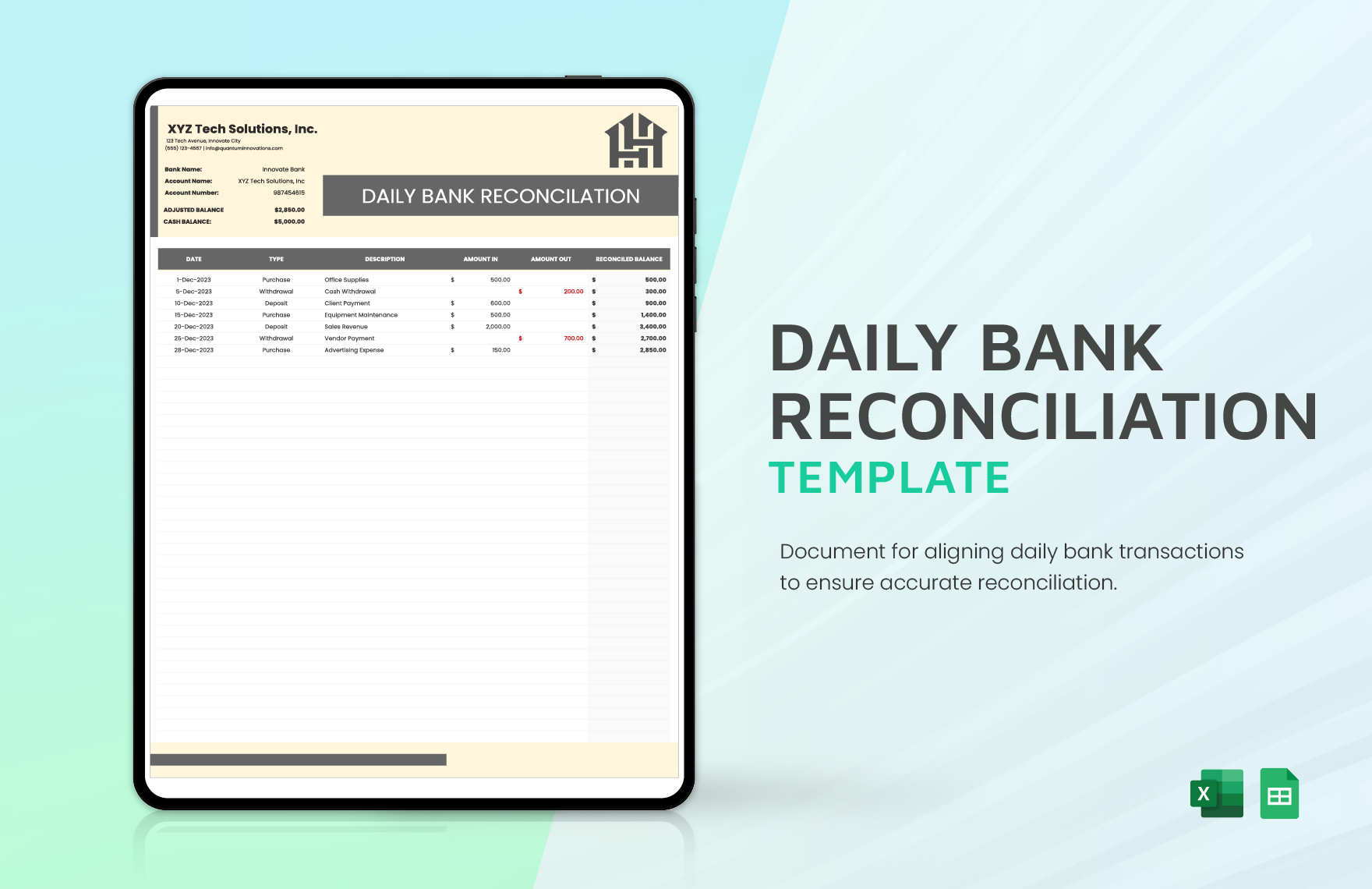

Editable Reconciliation Templates In Excel To Download

www.template.net

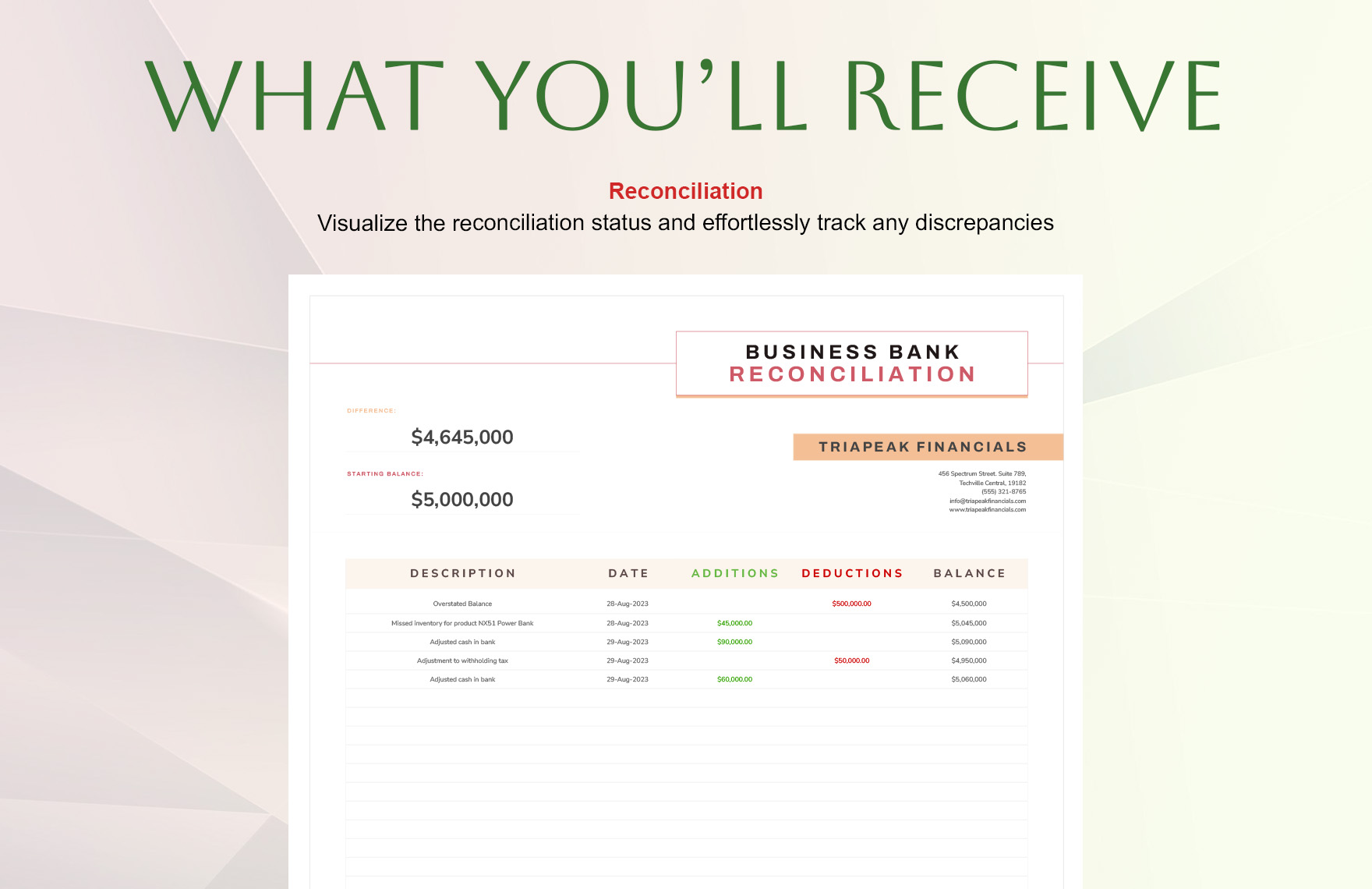

Business Bank Reconciliation Template In Google Sheets, Excel

www.template.net

Business Bank Reconciliation Template In Google Sheets, Excel

www.template.net

Editable Reconciliation Templates In Excel To Download

www.template.net

Business Bank Reconciliation Template In Google Sheets, Excel

www.template.net

Editable reconciliation templates in excel to download. Business bank reconciliation template in google sheets, excel. Editable reconciliation templates in excel to download